Markets Rally and Oil Plunges After Trump Announces Ceasefire Between Iran and Israel – Here’s What It Means

Picture this: global markets wake up to headlines that feel almost impossible—“ceasefire between Iran and Israel.” That’s exactly what happened when former President Trump announced a ceasefire after 12 tense days following strikes on Iran’s nuclear sites. The result? A wave of relief washing over investors. Stocks surged, safe-haven assets like gold and the U.S. dollar slid, and oil prices dropped to levels not seen in two weeks.

Let’s break down that morning. In New York, S&P 500 futures jumped nearly 0.9%. In Asia-Pacific, markets in Tokyo, Hong Kong, and Seoul rallied between 1–2.6%, reflecting a sudden shift in mood. In India, the rupee soared 0.9%, making its biggest daily gain in a month, as oil-import savings ignited investor hope.

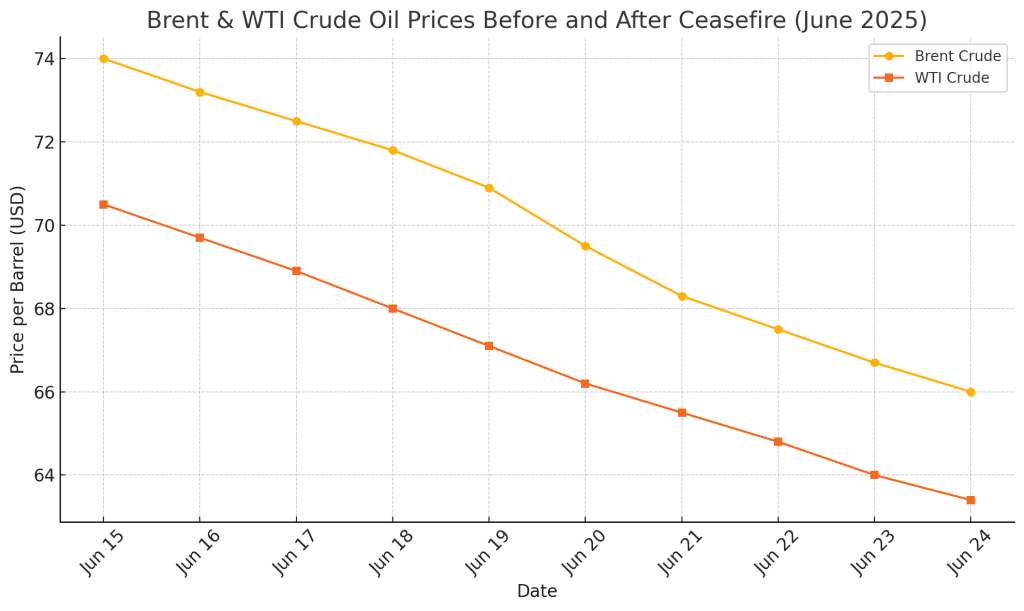

Oil, which had spiked during the conflict, plunged. Brent crude dropped toward $66–67 a barrel, US crude fell similarly—unlocking breathing room for consumers, businesses, and central banks worried about inflation. And gold followed suit, sinking to a two-week low, the classic sign that markets felt safer and were stepping out of defensive trades.

Even the U.S. dollar weakened as investors shifted into riskier assets, boosting currencies like the euro, yen, pound, Aussie, and Kiwi. Treasury yields crept higher, gently signaling growing confidence in growth and easing recession fears.

Emotionally, things changed overnight. There’s something comforting when traders can breathe again. It’s the sound of global commerce pressing play—not war premiums throttling everything into slow motion. Investors didn’t just buy stocks; they bought back optimism.

Still Caution in the Joy: Real Talk and What’s Next

Now, if you’re thinking this is all sunshine, let me mix in some realism. The ceasefire remains fragile. Within hours, both Iran and Israel were accusing each other of violations. While Trump stood firm, calling it a “forever ceasefire”, the reality is more complicated. Market watchers know peace isn’t linear—the next flare-up is one misstep away.

That explains why oil, after its initial drop, stalled back near $70 as investors weighed risks. But overall, the tone shifted. Barclays analysts highlighted that oil’s rally due to nuclear strikes wasn’t signaling a full-blown cut in supply—something the market is now digesting.

For central banks, the timing couldn’t be more telling. With inflation still buzzing around too-high levels, easing tensions brought hope for rate cuts. The Fed’s Bowman and Waller hinted that cuts in July might happen if conditions hold—boosting hopes across the board. Meanwhile in the UK, Bank of England Governor Bailey urged caution—pointing to U.S. trade tension risks—showing not everyone is ready to relax yet.

From an investor’s edge, this is a chance to reassess. Airlines like Carnival and United saw stock boosts as cheaper fuel promised profitability. Emerging market currencies strengthened; India’s rupee saw a big lift, as cheaper oil gave breathing room to import-heavy economies. In the Gulf, Saudi, Dubai, Abu Dhabi, and Qatar markets jumped 2–3% as calm replaced worry.

Yet, many analysts are flat-out saying: “Don’t pack away your stress just yet.” A second wave of rockets or naval tension in the Strait of Hormuz—and oil could quickly rebound. Central banks may still hold off raising rates, but a premature cut could worsen inflation.

What It Feels Like for the Rest of Us

At the end of the day, we’re all tuned into these shifts. Lower oil might mean cheaper petrol, and some relief on grocery shelves. Payrolls and consumer sentiment get a boost—maybe people spend more knowing rates could ease soon. One day, dictatorships fire missiles, the next, markets light up globe over.

Here’s a real image: a small cafe owner in Mumbai notices lower wholesale fuel prices—which lowers delivery costs and raises hope that customers might come out more. A retiree in San Francisco watches their IRA tick up as stocks rise. A commuter in London sighs when petrol drops by a few cents—every bit helps.

Of course, that owner knows these gains hang by a loose thread. He checks the news—listens for new headlines. We all do. But for now … for just this moment … that sigh feels a little deeper. A little sweeter. It’s rare peace, priced into real-world choices, across continents.

This isn’t a permanent reset. But it’s a pause—a much-needed one. Markets love it when uncertainty goes quiet. Investors like when fuel costs go down. Families like when food price growth slows. And global leaders like when they can talk about trade instead of war.

If this ceasefire holds, we could see this relief repeat in weeks. If not, the entire mood could shift back in a heartbeat. So yes, cheer the charts today—but don’t put your guard down tomorrow.