The Harsh Truth: How the “Get a Degree, Get a Job” Promise Has Left a Generation Trapped in Debt

How College Became a Debt Trap Disguised as a Dream

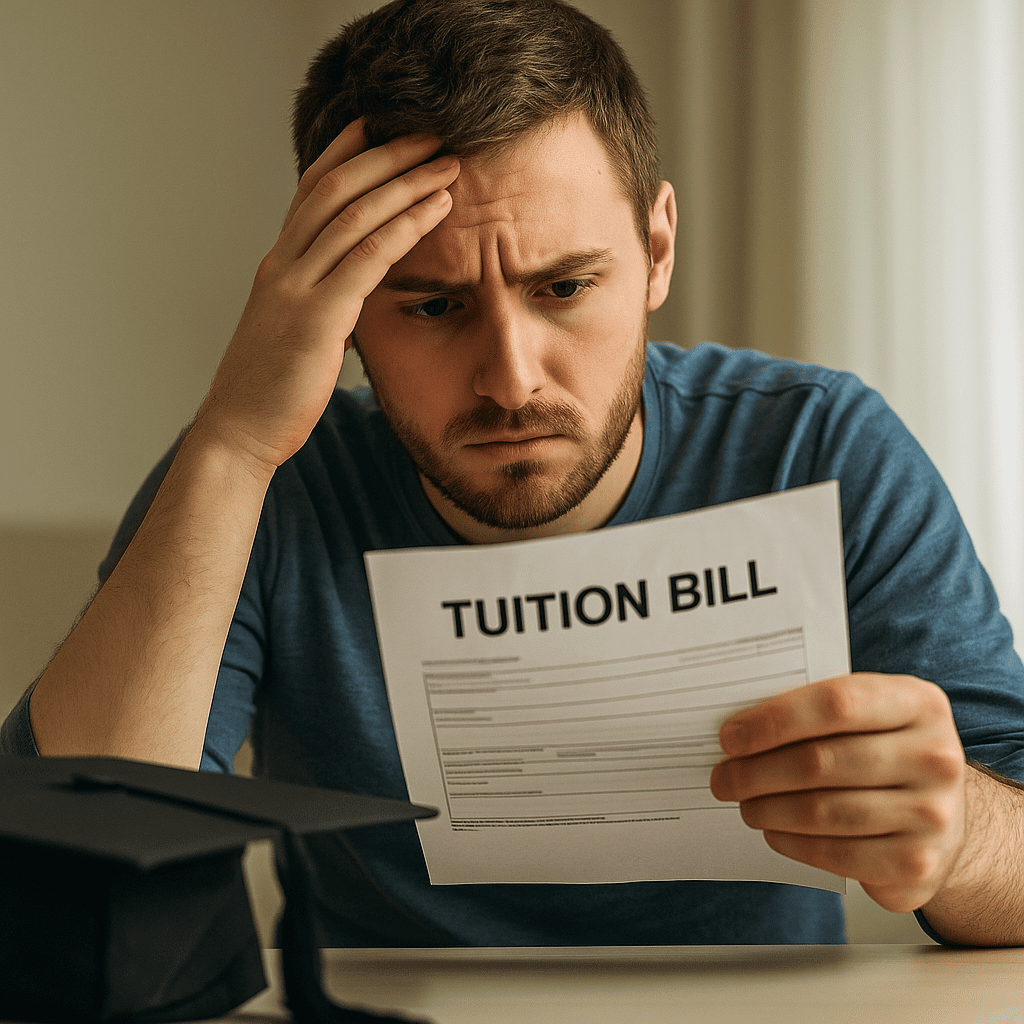

I was in my dorm room when I saw the email: “Your tuition bill is due.” My heart sank. It was like a punch in the gut. I’d worked so hard to get in—now it felt like I was signing up for a lifetime of debt.

If that sounds familiar, you’re not alone. Across America, millions of students chase the promise: get a degree, get a job. But for many, that promise is a lie. It’s a system built to funnel money—not opportunity—into the pockets of institutions.

Let’s start with something simple. Gen Z is losing faith in college. A recent Business Insider article revealed that many in tech now say college is an unnecessary detour. One student canceled Stanford for an internship at Palantir. Another 25-year-old high school dropout turned a Minecraft server into a startup that hit a $1 billion valuation. These aren’t flukes—they signal a deeper shift. People are asking: why pay $40,000 a year when you can learn online, build skills, and skip the debt?

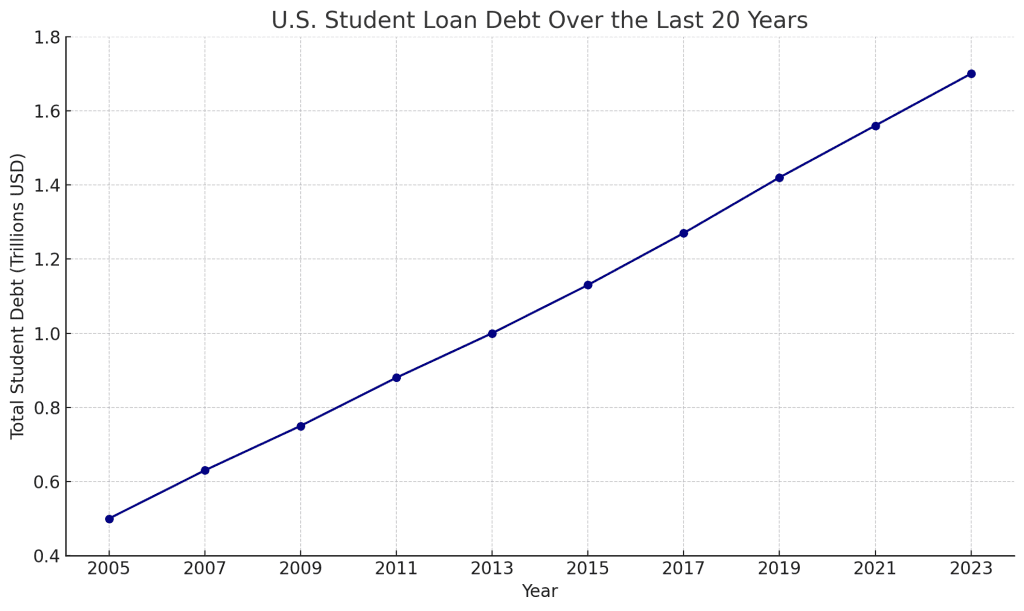

The debt? It’s real. U.S. student debt sits near $1.5 trillion. Loans outnumber students. Meanwhile, trust in college has tanked—Gallup reports only 36% of Americans have a great deal of confidence in higher ed, down from 57% in 2015.

It gets worse. Nearly half of young adults question whether college is worth it unless they can avoid loans. If they need loans, just 22% believe it’s worth it. That skepticism is jolting—because college used to be untouchable.

Hidden Paths: Alternatives Universities Don’t Want You to See

So, what should you do instead? Let’s explore the paths most colleges won’t tell you about.

1. Income-Share Agreements (ISAs)

ISAs let students pay nothing up front, then give a portion of their income after graduation. Sound good? Not always. Regulators say some ISAs are just disguised loans. San Francisco’s BloomTech had to pay fines after misleading students—turning ISAs into expensive debts.

2. Skill-Based Training & Bootcamps

Platforms like Coursera offer free courses in data analytics, coding, and digital marketing. Forbes praises them as high-income skills you can learn in months, not years. Spend $0–$500, learn fast, and avoid a $20,000–$100,000 debt.

3. Apprenticeships & Tech Internships

Employers like IBM, Google, and McKinsey are hiring for skills, not degrees. A recent report calls it the “tear the paper ceiling” movement. Companies want practical ability—a coder who can solve problems, even without that college crest.

4. Non-College Career Programs (e.g., Year Up)

Organizations like Year Up train young adults—without degrees—to land high-paying jobs through training and internships. Six years later, graduates earn 30% more than peers who took the traditional college route. Imagine that: real results, no debt.

5. Starting Your Own Venture

Plenty of young entrepreneurs are doing just fine—no diploma needed. Reddit users call skills like sales, problem-solving, and customer success true money-makers. One comment said it best: “Software engineering is just a skill like swinging a hammer.”

Where We Go Next

Look, I get it. College has its virtues. Networking, structure, communal life. But here’s the turning point: when the cost outweighs the benefit. A 2024 Gallup survey showed most adults only support college if it’s debt-free. And with default rates sky high, especially for for-profit schools—who took billions in federal aid only to fail their students—it’s hard to argue the system is working.

These for-profits have shut campuses, lied about job placement, and left students holding worthless diplomas and crushing debt. It’s predatory. It’s a crisis.

If you’re thinking about life after high school or wondering why college might not be the smartest move, here’s a better plan:

- List your skills and passions.

- Explore free or cheap courses online.

- Try internships or apprenticeships.

- Join programs like Year Up or bootcamps with proven outcomes.

- Start building a portfolio or side hustle now—not after college.

You don’t need permission from any institution. You need discipline, intent, and the willingness to learn in the real world.

Institutions are slow to change. Regulators are beginning to step in—like with BloomTech’s settlement. But the real change is grassroots. Skills-first hiring, online education, and self-made success stories are building a new norm.

One Reddit user summed it up perfectly:

“The real high income skills are problem solving and creating value for your end user.”

That’s the shift. From chasing a paper degree to showing you can solve real problems.