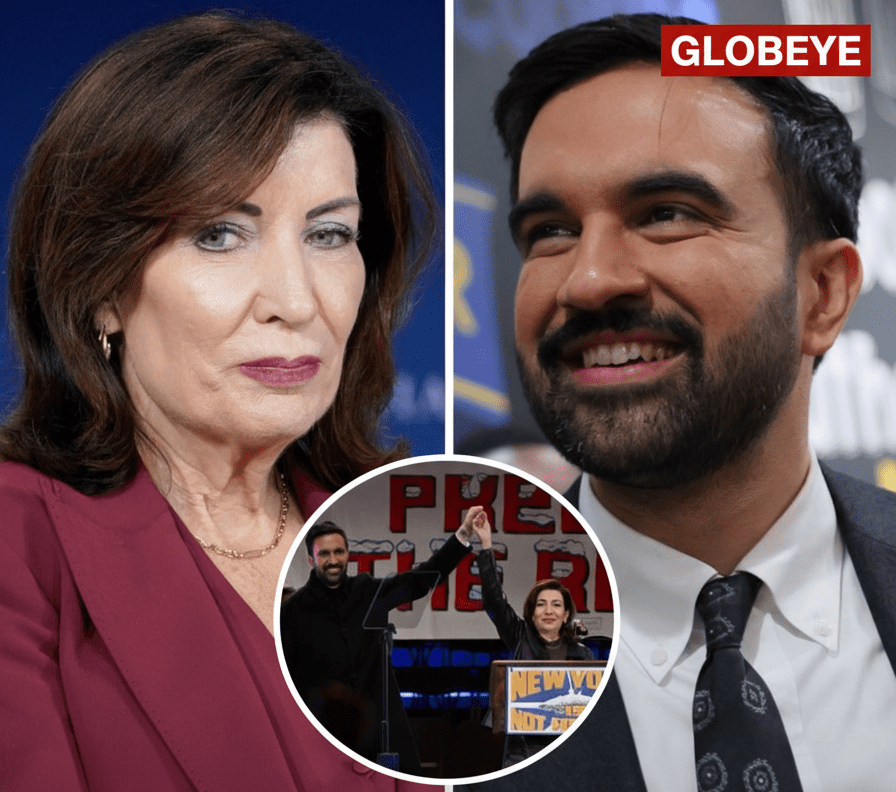

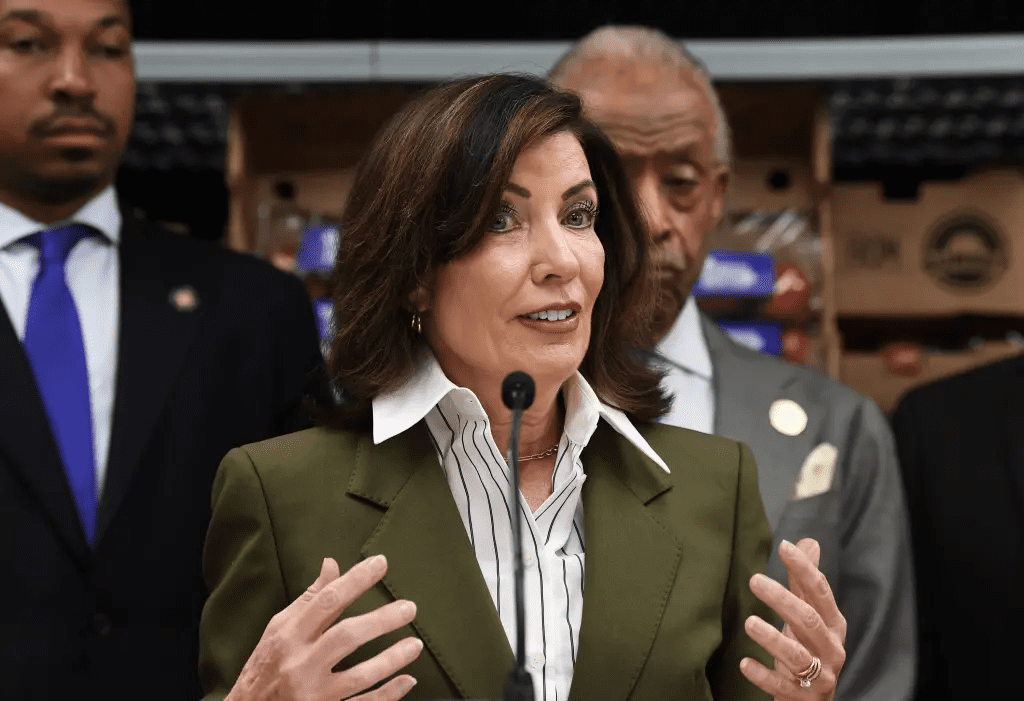

New York Governor Kathy Hochul Warns Zohran Mamdani’s Tax-the-Rich Agenda Could Crush the Middle Class — “I Cannot Do That” She Admits

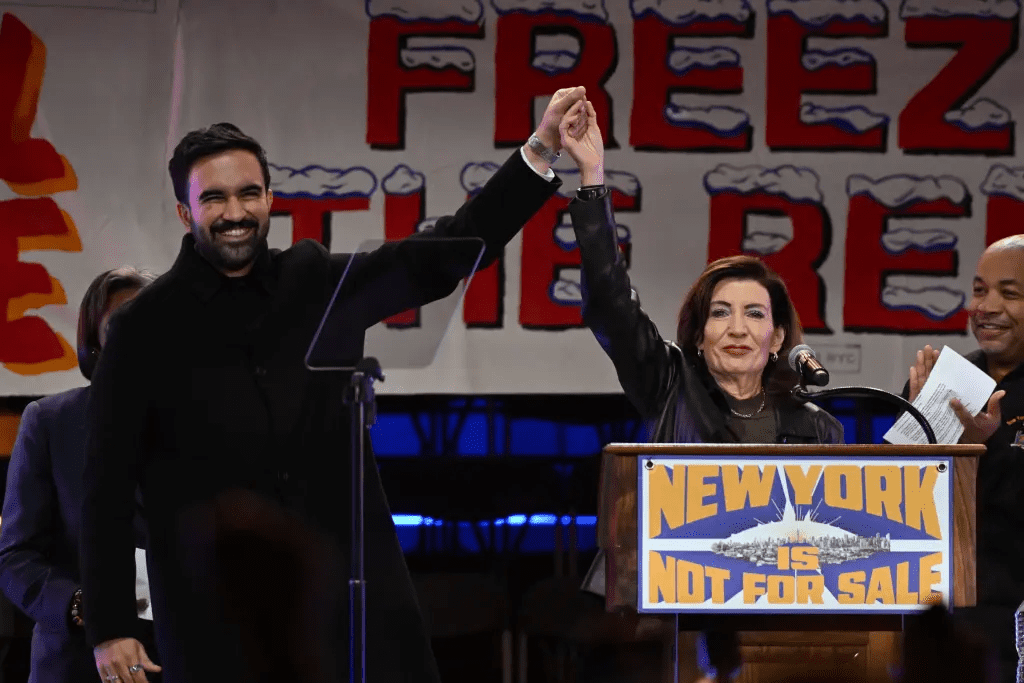

New York Governor Kathy Hochul found herself in political crosshairs after publicly rejecting the aggressive tax-the-rich agenda championed by mayoral front-runner Zohran Mamdani. At a high-profile rally this past weekend, supporters of Mamdani — a self-described democratic socialist — erupted in chants of “tax the rich” while Hochul stood beside him. The scene sparked a sharp response from the governor, who later told reporters that she simply could not support middle-class tax hikes to fund the radical proposals.

The confrontation exposed a deep fault line within New York’s Democratic Party. Hochul, who had endorsed Mamdani earlier in September, has long presented herself as a centrist steward of the state’s economy — one who will protect businesses and middle-income taxpayers. Yet the rally moment thrust her onto unfamiliar terrain: caught between progressive zeal on the one hand and fiscal caution on the other. When asked directly about expanding income taxes on high-earners, Hochul affirmed her position: “I cannot make up for that with middle-class tax increases. I cannot do that to the middle class and the struggling New Yorkers.”

Mamdani’s economic platform, known informally as “Zohranomics,” relies on bold pledges such as universal childcare, free subway fares, rent freezes, and new affordable-housing programs. To pay for it, his campaign proposes raising taxes on millionaires and corporations. A Reuters breakdown of his plan earlier this year calculated that the business and top-earner tax hikes would generate billions annually — but also risk triggering an exodus of New York’s most affluent residents. Hochul’s shift in tone reflects those fears. She warned that driving wealthy taxpayers out of the state would hurt revenue and ultimately place more burden on the rest of the populace.

The politics of the moment are sharply stacked. Hochul faces a looming budget gap — analysts place it at around $27 billion over the next three-year cycle — while federal aid flows recede. With Registered voters growing uneasy about taxes and affordability, the governor is walking a tightrope between progressive demands and economic reality. Republican critics lambasted Hochul’s balancing act as proof that she is being pushed by the far left while abandoning the moderates and working-class voters her campaign once courted.

For Mamdani, the episode both boosts and complicates his appeal. While the “tax the rich” rhetoric energizes grassroots supporters and helps draw a sharp contrast with his rivals, the public tussle with his own party’s governor underscores the breadth of resistance he faces. Business groups in New York City reacted nervously when Mamdani told wealthy executives that he planned to raise taxes on rich people and corporations — “less than comforting,” in one observer’s words.

As the race for mayor intensifies, the tax debate has become the defining fault line. Hochul’s public distancing from Mamdani’s revenue plans marks a strategic repositioning; the governor is signaling that while she may share some policy goals with the socialist contender, she will not be the guarantor of sweeping tax increases. That distinction could prove decisive, particularly among middle-income voters who fear spending cuts, service losses or hidden tax hikes.

In the weeks ahead, how the Democratic coalition reconciles the progressive base’s appetite for change with the broader electorate’s reluctance to pay more will shape not only the outcome of one mayoral race, but perhaps the future direction of New York’s politics.