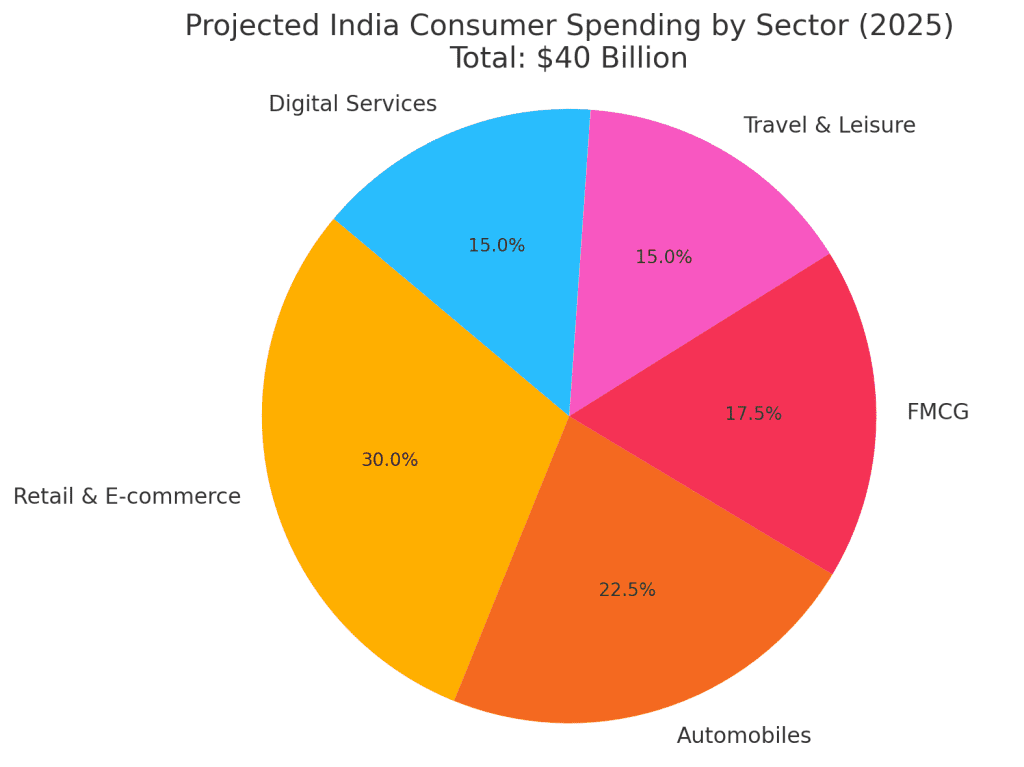

India Is On the Verge of a $40 Billion Consumer Explosion—Here’s What It Means for the World

There’s something stirring in the heart of India—and no, it’s not just another tech startup or cricket win. It’s something far bigger. According to multiple economic reports, India is on the edge of a massive $40 billion consumer spending surge that could reshape not only its own economy but influence markets worldwide.

And it’s not a far-off dream. This boom is expected to hit within the next 18 to 24 months.

To some, this might sound like just another headline about growth in the Global South. But for those watching closely, this is different. This is personal. It’s happening on the streets, in the shopping malls, on e-commerce carts, and in bank accounts of everyday Indians who are slowly, confidently stepping into a new phase of economic power.

Why Now? A Perfect Storm of Pay Raises, Tax Cuts, and Dreams

Let’s break down how this is all unfolding.

First, there’s been a consistent rise in middle-class salaries across sectors like IT, banking, education, and services. Even government employees have seen recent pay adjustments. And with a younger workforce making up nearly 65% of the population, more and more Indians now have disposable income—and they’re ready to use it.

Second, income tax cuts and relaxed lending rules are adding fuel to the fire. For the first time, many families are breathing easier financially. Banks are offering easy home loans, car loans, and even vacation financing at attractive rates. Credit is no longer just for the rich. It’s now for the salaried millennial in Pune, or the school teacher in Lucknow planning their first family vacation.

One report from The Times UK put it plainly: this $40B is not just a number—it’s a movement. The combination of economic reform, rising aspirations, and digital infrastructure has created an inflection point.

And then there’s e-commerce. With platforms like Flipkart, Amazon, Meesho, and Nykaa reaching tier-2 and tier-3 cities, people are shopping more than ever. No longer just for essentials—but for quality, lifestyle, and convenience.

The boom is real—and it’s deeply human.

The Real Impact: From Local Markets to Global Stocks

If you think this is just good news for local brands, think again.

Global investors are watching this unfold like hawks. Why? Because India’s growth could outpace mature economies in the very sectors that have stagnated in the West: consumer goods, personal finance, fintech, retail, and entertainment.

Imagine what happens when tens of millions of people suddenly start buying appliances, upgrading phones, choosing branded clothes, and streaming premium content at scale.

Brands like Unilever, Nestlé, and Apple are already increasing their India footprints. So are budget smartphone makers, two-wheeler companies, and FMCG giants like Dabur and Marico.

One trader in Mumbai said in a CNBC report,

“What we’re seeing is not a bubble. It’s a shift in how Indians see their own future—and they’re willing to spend to live better.”

Even the automobile industry is seeing the effect. SUV sales in India hit record highs in the past six months, as consumers increasingly favor larger, family-friendly vehicles with status appeal.

And this boom isn’t just urban.

Rural India, often overlooked, is experiencing a rise in digital payments and banking access. Government subsidies and UPI penetration are allowing small-town shopkeepers to upgrade their businesses—and their lifestyles.

The Cultural Shift: What This Boom Really Feels Like

Here’s where it gets emotional. This isn’t just about cash flow and balance sheets. This is about aspiration.

Walk into a shopping mall in Delhi or Hyderabad and talk to families. You’ll hear a shift in tone. They’re not just buying—they’re choosing. Not just spending—they’re upgrading.

People are investing in education, travel, health insurance, and better homes. They’re looking beyond survival, toward a life of dignity and comfort. For a country that’s spent decades fighting poverty and inflation, this moment feels different. It feels deserved.

Take 29-year-old Karan from Ahmedabad. A first-generation college graduate, he recently bought a car for his parents and enrolled in a weekend MBA program. “My father never took a loan in his life,” he says. “Now I have three—and I’m not afraid of them. I’m investing in life.”

Or Shreya, a newlywed in Bengaluru, who’s spending her evenings browsing wedding photographers and designer sarees on Instagram. “Our parents saved everything. We spend wisely, but we also live,” she says.

These aren’t isolated stories. They’re part of a growing narrative: India isn’t just earning more—it’s dreaming bigger.

The Warning Signs (Because Every Boom Has Them)

While the excitement is real, some economists are urging caution. Rising consumer debt, uneven rural access, and global interest rate fluctuations could slow the momentum. Inflation in food and fuel prices also poses a risk to disposable income.

But compared to a decade ago, India is better equipped to handle such shocks. The Reserve Bank of India (RBI) has kept inflation largely under control. And digitization in banking and taxation is helping the government track, support, and respond in real time.

There’s still a long way to go, of course. But the fundamentals are strong—and optimism, for once, feels justified.

What Happens Next?

In the next 18–24 months, you’ll likely see:

- A sharp rise in stock investments from first-time Indian investors

- Surging sales in consumer durables, electronics, skincare, and wellness

- More global brands entering India or expanding rural and digital outreach

- A booming wedding economy, now estimated at $75B+ annually

- Increased media consumption and OTT subscriptions across regions

- Real estate momentum in suburbs and tier-2 cities

For global observers, this is the moment to pay attention. India is not just a promising “emerging market” anymore. It’s becoming the engine room of the next consumer revolution.

And for Indians? This is a rare moment in history where confidence meets opportunity. Where a generation no longer has to choose between saving for tomorrow or living for today.

That’s not just economics. That’s life-changing.