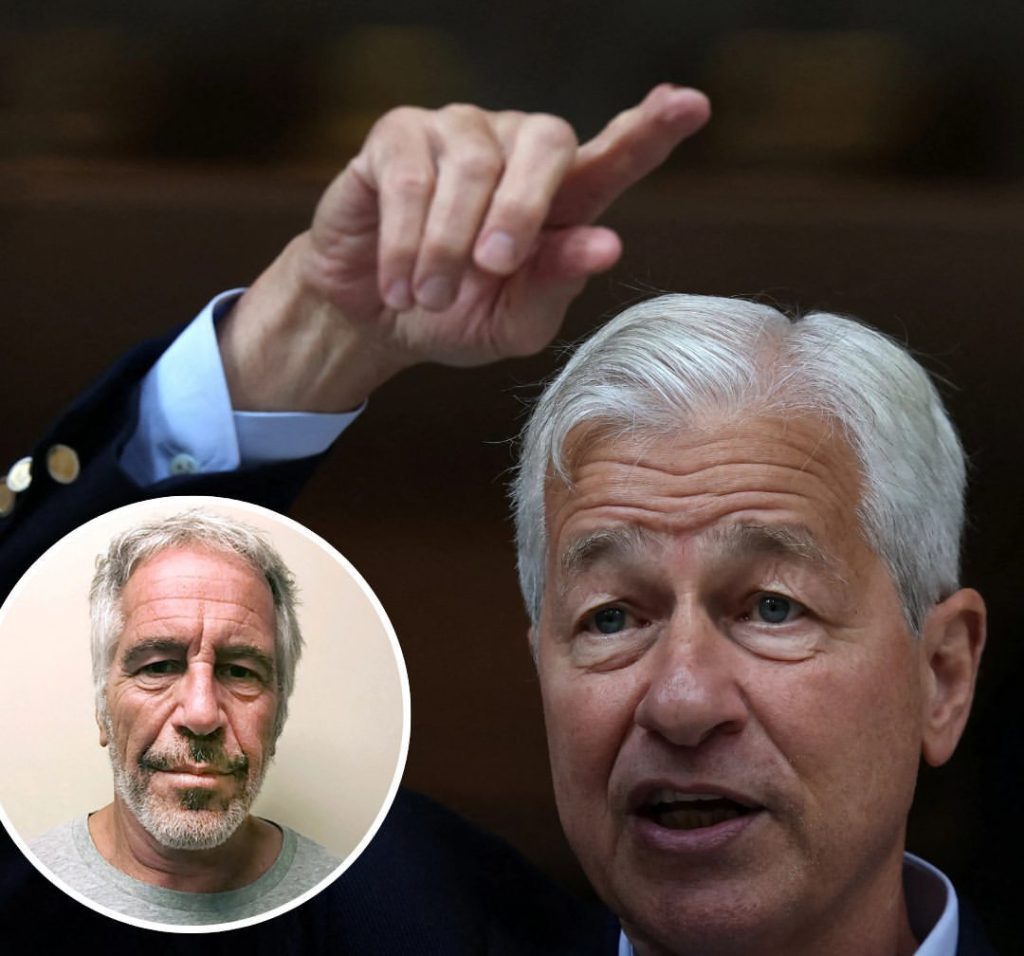

Why JPMorgan Quietly Paid Jeffrey Epstein After the 2008 Financial Crisis Exposed Wall Street’s Darkest Secrets

When the 2008 financial crisis shook the global economy, most of the focus fell on Wall Street banks, reckless lending, and the collapse of the housing bubble. But buried beneath the chaos was a strange connection that would only come to light years later: JPMorgan’s relationship with Jeffrey Epstein, a man who was already a convicted sex offender at the time. The idea that one of the most powerful banks in the world quietly paid off someone like Epstein after the crisis still raises eyebrows today, and it shines a harsh light on how deep financial and personal networks ran during one of America’s darkest financial hours.

It all began in 2007, when two Bear Stearns hedge funds imploded under the weight of toxic mortgage bonds. That implosion became the first domino to fall in the global financial crash that soon followed, a collapse so massive it wiped out trillions of dollars in wealth and sent millions of people into unemployment and foreclosure. Bear Stearns, once a powerful name on Wall Street, didn’t survive the storm. In March 2008, JPMorgan swooped in, buying the crumbling firm in a fire-sale deal backed by the U.S. government. On the surface, it looked like a straightforward rescue. But as lawsuits and investigations later revealed, the deal brought along a tangled web of connections, including financial ties to Jeffrey Epstein.

Epstein had been close to some of Bear Stearns’ leadership before the crash. He once started his career at Bear Stearns decades earlier, building relationships with people who would rise to powerful in finance. Even after his 2008 conviction for soliciting prostitution from a minor, he continued to enjoy influence in elite circles, from business to politics. Court filings later showed that JPMorgan, after acquiring Bear Stearns, maintained Epstein as a client for years. What’s even more surprising is that in the years following the financial crisis, settlements and payments linked to Epstein began to surface, forcing JPMorgan into the uncomfortable position of explaining why one of the world’s biggest banks continued to deal with him.

The bank has since faced lawsuits accusing it of ignoring Epstein’s criminal record and allowing him to move money through accounts that may have supported his abusive activities. Internal communications unearthed in legal proceedings showed that some executives at JPMorgan were aware of Epstein’s background, yet the relationship continued. In fact, reports revealed that JPMorgan eventually paid sizable sums tied to Epstein, raising questions about whether the bank was trying to distance itself quietly without drawing too much public scrutiny.

For ordinary people who lost homes, jobs, and retirement savings in 2008, the revelation that a convicted predator was still being served by America’s most powerful bank feels like a gut punch. The financial crisis was supposed to be a reckoning for greed and reckless behavior, yet here was another example of how influence and connections seemed to shield certain figures from consequences. Epstein, who presented himself as a financier despite his criminal record, used his wealth and social ties to remain connected to elite institutions, and JPMorgan’s involvement only added to the perception that accountability was selective.

JPMorgan has denied any wrongdoing in maintaining Epstein as a client, saying that its executives did not knowingly enable his crimes. But the settlements and payouts suggest the bank understood the reputational risk it carried by being tied to him. It is a reminder that in the rarefied air of Wall Street, money and power often speak louder than morality. For the public, the story of JPMorgan and Epstein is more than just a scandalous headline. It’s a window into how the financial system can bend rules for those who already have power, even as it leaves ordinary people to pick up the pieces.

The 2008 crash may have ended nearly two decades ago, but its aftershocks are still felt today. Families who lost everything remember the crisis as a betrayal by the very institutions they trusted. And now, knowing that a figure like Epstein was still able to profit and move freely in that same era makes the entire period look even darker. The truth about why JPMorgan paid off Epstein may never be fully known, but what’s clear is that the lines between finance, influence, and secrecy ran much deeper than most imagined. It’s a story that reminds us the past isn’t really past, and that the choices powerful people make in private can ripple out for generations.