Big Win for Homebuyers: U.S. Mortgage Rates Drop to 6.19%, the Lowest of 2025, Sparking Hopes of a Real Estate Revival

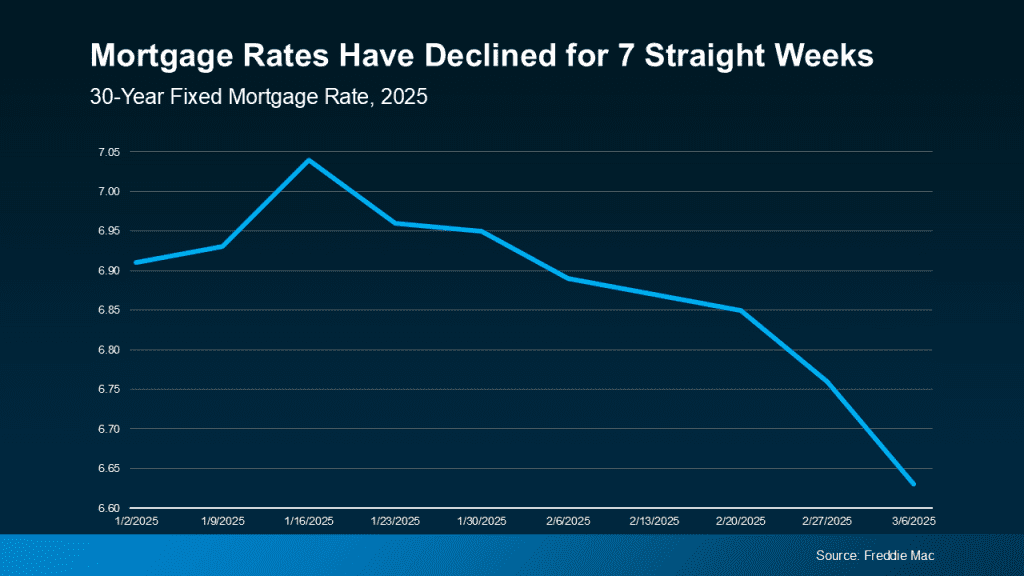

In a major boost to American homebuyers, mortgage rates have dropped to their lowest point of the year. According to Freddie Mac’s latest report, the average rate for a 30-year fixed mortgage now stands at 6.19%—a remarkable slide from over 7% recorded at the start of 2025. This decline marks a significant shift in the housing market, offering much-needed relief to buyers who have spent months grappling with high borrowing costs and limited affordability.

For the average American household, the difference is more than symbolic. At the new 6.19% rate, monthly payments on a $400,000 home are roughly $150 lower than they were in January. That change could mean the difference between renting and owning for many first-time buyers. Economists say the drop is primarily driven by easing inflation, cooling bond yields, and the Federal Reserve signaling a pause—and potentially even cuts—in interest rates heading into 2026.

The timing could not be better for the housing sector, which has struggled under the weight of two years of elevated rates. Sales have lagged roughly 20% below pre-2022 averages, and homebuilders have faced declining demand even as supply shortages persist. Now, the lower mortgage rate environment could inject new life into the real estate market just in time for the fall buying season.

President Donald Trump’s administration has welcomed the trend as a sign of market confidence and monetary stability. While the rate drop is primarily a function of broader economic factors, many see it as a reflection of improving investor sentiment and renewed faith in the nation’s economic outlook under Trump’s leadership. His recent statements emphasizing deregulation, energy independence, and lower inflation targets have been widely viewed as boosting confidence in long-term growth. Supporters argue that such signals have encouraged markets to price in reduced risk and lower yields—both of which directly influence mortgage costs.

The new mortgage rate level is also notable because it represents a reversal from the steady climb seen during the first half of the decade. When the Federal Reserve raised interest rates sharply in 2022 and 2023 to combat inflation, mortgage costs skyrocketed, freezing out many middle-income buyers. By early 2025, rates hovered just above 7%, and housing affordability had fallen to a four-decade low. But now, as inflation cools and confidence improves, borrowing has finally become more attainable again.

Still, housing experts urge caution. While lower rates may spark new interest, home prices remain elevated in many regions due to persistent supply shortages. Some economists warn that if demand surges faster than supply can adjust, it could push prices even higher, offsetting some of the benefits of cheaper borrowing. Others, however, argue that the combination of steady wage growth and a healthier mortgage landscape could restore balance to the market by early 2026.

For prospective homeowners, the change is both economic and emotional. After years of frustration and uncertainty, lower rates offer hope. Families who were forced to delay buying because of rising costs may now have a chance to step into the market, and sellers, too, may find renewed activity as more buyers return.

In a broader sense, this mortgage shift also signals something deeper about America’s economic trajectory. It represents easing pressure after years of financial strain, the slow but steady normalization of markets, and the potential return of stability. Whether this momentum continues will depend on the Federal Reserve’s next moves and how global markets respond to signs of slowing inflation.

For now, the message is clear: mortgage relief has finally arrived. And with the average rate at its lowest point of 2025, optimism—long absent from the housing conversation—is beginning to return.