How the ‘Madoff of Landlords’ Screwed Tenants for Decades Before His Manhattan Empire Implodes in a $170 Million Loan Avalanche

In the shadowed alleys of Manhattan’s Lower East Side, where fire escapes sag like weary sentinels and the hum of delivery bikes drowns out dreams deferred, Steven Croman once ruled like a feudal lord—his empire a labyrinth of crumbling tenements that housed the city’s strivers while lining his pockets with ruthless precision. It was a reign built on the backs of the working poor, from immigrant families crammed into illegal conversions to artists priced out of their lofts, all paying rent to a man whose smile masked the machinations of a modern-day Madoff. But on November 19, 2025, as court filings unsealed in New York Supreme Court painted a portrait of financial freefall, Croman’s kingdom cracked wide open: defaults on nearly $170 million in loans, foreclosure threats looming over 35 prime properties, and a reckoning that feels less like justice and more like the inevitable collapse of a house of cards stacked too high on sleight of hand. For tenants like Maria Gonzalez, a 42-year-old cleaner who’s called one of Croman’s walk-ups home for 15 years, the news landed like a long-withheld exhale—a bitter victory for those who’d battled his harassment for decades, only to watch him slip the noose of true accountability time and again.

Croman’s story isn’t one of rags to riches; it’s a tale of calculated climbs, where a Brooklyn-born hustler with a knack for numbers turned his father’s modest painting business into a real estate behemoth worth $1 billion at its peak. By the 1990s, the 30-something Croman was snapping up distressed buildings in Alphabet City, those graffiti-scarred relics of the East Village’s wild days, flipping them with the finesse of a card shark. He wasn’t content with steady rents; he pioneered the “Croman model”—aggressive renovations that displaced tenants through bogus violations, buyouts bullied, and basements illegally subdivided into warrens for desperate newcomers. “It was like living in a pressure cooker,” recalls Gonzalez, her voice thick with the accent of her Puerto Rican roots as she stands in the lobby of 123 Ridge Street, a Croman holdout where peeling paint and leaky pipes are as familiar as family. “He’d send inspectors to nitpick, jack the rent, make you feel like you didn’t belong. But where do you go when Manhattan’s your whole world?” For Gonzalez, a single mom raising two teens on $18 an hour, Croman’s tactics weren’t business—they were betrayal, a slow squeeze that forced her neighbors out one by one, their stories echoed in tenant unions that fought back with lawsuits and sit-ins.

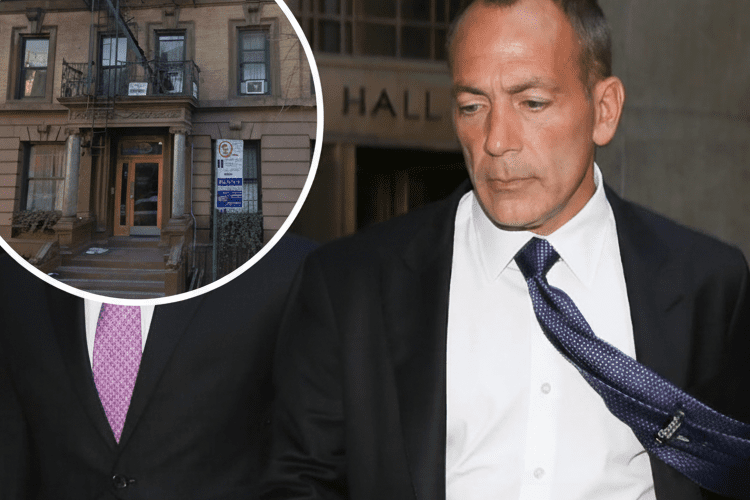

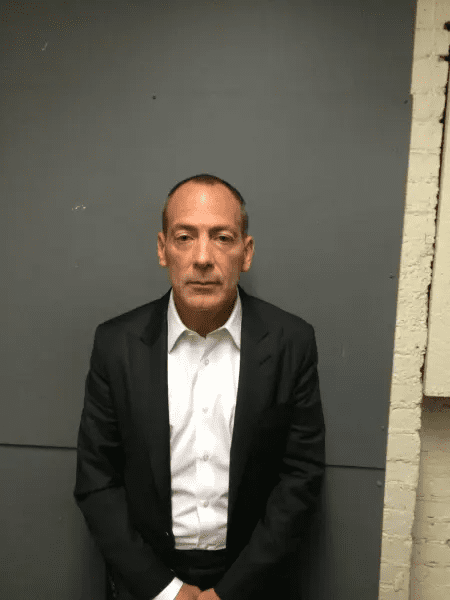

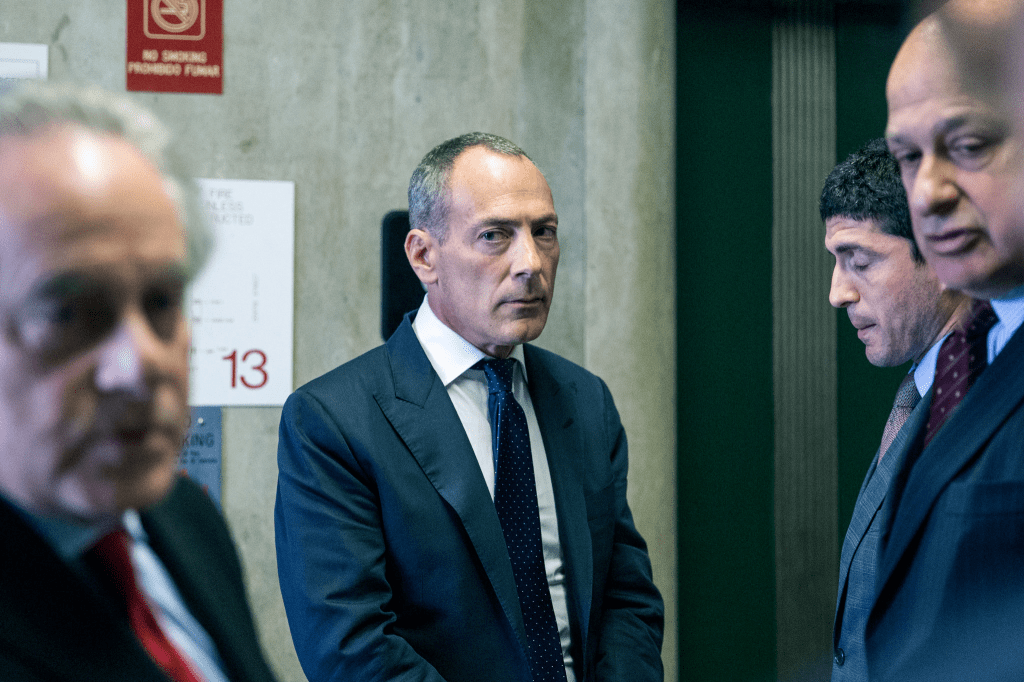

The empire’s underbelly began to show cracks in 2017, when Croman—then 53, with a salt-and-pepper beard that lent him a veneer of gravitas—pleaded guilty to grand larceny and criminal tax fraud, admitting to a scheme that siphoned $5.5 million from his tenants’ security deposits to fund his lavish life: a $10 million townhouse on the Upper East Side, private jets to the Hamptons, a collection of Porsches that purred like predators. Sentenced to a year on Rikers Island, he served just three months in a cushy work-release program, emerging in 2018 with a $5 million fine and a slap on the wrist that left activists seething. “Rikers was his country club,” quips Sarah Perl, a lawyer with the Urban Justice Center who represented dozens of Croman evictees, her office walls papered with yellowed court orders. “He walked out richer than most of us will ever be, and the properties kept churning cash.” Perl’s caseload tells the tale: over 200 harassment claims against Croman entities since 2015, from illegal lockouts to utility shutoffs, tactics that netted him $100 million in rent hikes while tenants like Gonzalez scraped by on Section 8 vouchers that barely covered the basics.

Fast-forward to 2025, and the reckoning Croman dodged for years has arrived not with handcuffs, but with the cold calculus of lenders calling in chips. Court records unsealed this week reveal defaults on $170 million across 35 Manhattan buildings—from luxury condos in Chelsea to rent-stabilized relics in Yorkville—loans from giants like Madison Realty Capital and RXR Realty that soured amid Croman’s overleveraged bets on a post-pandemic rebound that never fully materialized. The filings, a 150-page tome of ledgers and liens, paint a picture of desperation: properties like 123 Ridge, once a cash cow yielding $2 million annually, now hemorrhaging from vacancies and vacancies from lawsuits. Foreclosure suits from RXR alone target 15 sites, with auctions slated for January if Croman can’t cough up the collateral. “He’s the Madoff of landlords for a reason—built on smoke and mirrors,” says Perl, flipping through the documents in her cluttered office, the city skyline a hazy backdrop through rain-streaked windows. “Tenants paid the price for his Ponzi play; now the banks are collecting.”

For Gonzalez and her neighbors, the news is a double-edged sword—relief laced with rage, a chance to reclaim homes without the specter of Croman’s evictions, but a fear that new owners might flip the script to market-rate misery. “We’ve fought him for years—petitions, protests, even sleeping in the hall when he cut the heat,” she says, her hands twisting a rosary as she stands in the lobby, where exposed wires snake like veins from a recent “renovation.” “But what if the next guy is worse? We’re not rich; we’re just trying to hold on.” Gonzalez’s story is echoed in a chorus of Croman casualties: the elderly widow in 456 East 10th Street who lost her rent-controlled unit to a bogus “luxury” conversion, the young family in Yorkville evicted for “renovations” that never happened. The Legal Aid Society’s tally: over 1,000 displacements linked to Croman since 2010, a trail of tears that fueled his $1.2 billion portfolio before the defaults derailed it. In a city where median rents hit $4,000, Croman’s model preyed on the vulnerable, his 2017 plea a pause, not a period, in a saga of systemic sleight.

Croman’s fall isn’t just financial; it’s a fable of hubris, the kind that starts with a Brooklyn kid dodging dad’s paintbrushes to chase deals, peaking in the aughts when he snapped up foreclosed gems post-dot-com bust. By 2010, his Croman Group owned 2,000 units, a fiefdom where “improvements” meant harassment—falsified violations to trigger buyouts, sublets to proxies that skirted rent laws. The 2017 bust, triggered by a whistleblower tenant, exposed the rot: $6 million in unreported income, deposits diverted to his $50 million yacht fund. Rikers, for Croman, was a rude awakening—three months in protective custody, away from the polo ponies and private chefs—but he bounced back, refinancing with soft-money lenders who bet on his name. “He’s a survivor,” admits former associate David Rosenberg, now a rival broker, over coffee in a Midtown café, the skyline a smug spectator. “But survival’s no sin when the system’s set up for sharks.”

The emotional wreckage laps at the shores of those Croman cast aside, families like the Gonzalezes who’ve poured sweat into buildings he treated as ATMs. Maria’s daughter, 16-year-old Sofia, dreams of college but dreads the rent hikes that could dash it; her brother, 14, sketches comics in the hallway to escape the drafts. “Dad’s gone a lot, working doubles,” Sofia says, her voice small but steady, “but Mom says we’ll fight like always.” Perl’s team, buoyed by the filings, gears for tenant buyouts—$50 million in city funds for stabilization—but the path is paved with pitfalls: speculators circling like vultures, a housing market where “affordable” means $3,500 for a one-bed. For Croman, 61 and silver-haired, the suits signal sunset: his Upper East Side manse on the block, his fleet of Ferraris facing liens. “He’s not broke—just broken,” Rosenberg muses, a hint of schadenfreude in his sip. “The man who evicted dreams is getting evicted himself.”

As November’s chill bites the city, Croman’s crumble stirs a somber reflection on New York’s underbelly—the landlords who lord over lives, the tenants who tenaciously hold on. For Gonzalez, it’s a fragile hope: “Maybe now we get a fair shake.” For Perl, a call to arms: “This is the crack we need to flood with reform—rent caps, anti-harassment laws that bite.” In a metropolis of millionaires and migrants, Croman’s fall is a fable with a moral: empires built on exploitation eventually erode, leaving the ground fertile for fairness. As foreclosure dates loom, the Ridge Street lobby buzzes with tentative talks—neighbors plotting petitions, lawyers lining up. It’s not triumph, but tenacity, a city’s soul refusing to be rented away.