As Trump’s Antitrust Warning Looms Over Netflix’s $72B Play, Hollywood’s Merger Wars Heat Up with Stakes for Creators and Fans

In the sunlit boardrooms of a Century City high-rise, where the distant sprawl of Los Angeles shimmered under a December haze and the faint hum of script readings echoed from adjacent offices, David Ellison paced the length of a conference table on the morning of December 8, 2025, his mind racing through the numbers that could reshape Hollywood’s landscape. Ellison, the 43-year-old CEO of Skydance Media whose recent $8.4 billion merger with Paramount Global had catapulted him to the helm of a $30 billion entertainment empire, had just greenlit a bold counterpunch: a hostile all-cash bid for Warner Bros. Discovery at $30 per share, backed by his family’s equity stake and fully committed debt from Bank of America, Citi, and Apollo Global Management. The offer, matching the one WBD rebuffed the previous week, arrived as a direct challenge to Netflix’s seismic $72 billion swoop for the studio and streaming giant—a deal announced December 5 that would fold HBO, HBO Max, and Warner’s film slate into the streaming behemoth’s fold, potentially reaching 400 million subscribers worldwide. For Ellison, whose father Larry’s Oracle fortune provided the seed money for Skydance’s rise from a 2006 startup to a Top Gun producer, the bid wasn’t just business; it was a personal stake in the industry that had defined his life, a chance to preserve the collaborative magic of theaters and talent in an era where streaming’s algorithms often eclipse the human spark of storytelling. As he signed the term sheet, Ellison glanced at a framed photo of his first film set, the weight of the moment settling like the L.A. fog outside—a reminder that in Hollywood’s high-stakes poker game, every all-in bet carries the dreams of creators who’ve poured their hearts into the reels.

The Paramount Skydance offer, detailed in a press release that hit wires at 9:15 a.m. PT, positions the merged entity as a “superior alternative” to Netflix’s partial buyout, promising a “more certain and quicker path to completion” for WBD shareholders while acquiring the full company, including TV networks like CNN and Discovery. Ellison, speaking live on CNBC’s “Squawk on the Street” at 10 a.m., elaborated with the confidence of a filmmaker turned mogul: “We’re ready to finish what we started—providing value that honors Warner’s legacy of bold storytelling.” The bid, valuing WBD at $82.7 billion including debt, mirrors the rejected Paramount proposal but adds the allure of a single-entity deal, avoiding the regulatory headaches of Netflix’s carve-out. Skydance’s merger with Paramount, approved by the FCC in July 2025 after a 14-month review that cleared antitrust hurdles, had already blended Ellison’s nimble production house—behind hits like Mission: Impossible sequels—with Paramount’s storied library, including Star Trek and Transformers. Now, folding in WBD’s HBO crown jewels and DC Comics empire could create a $110 billion colossus, challenging Disney’s $200 billion perch. For Ellison, whose path from USC film student to CEO was paved by his father’s tech billions, the play feels like destiny: “This is about uniting visions that inspire—giving audiences stories that matter.”

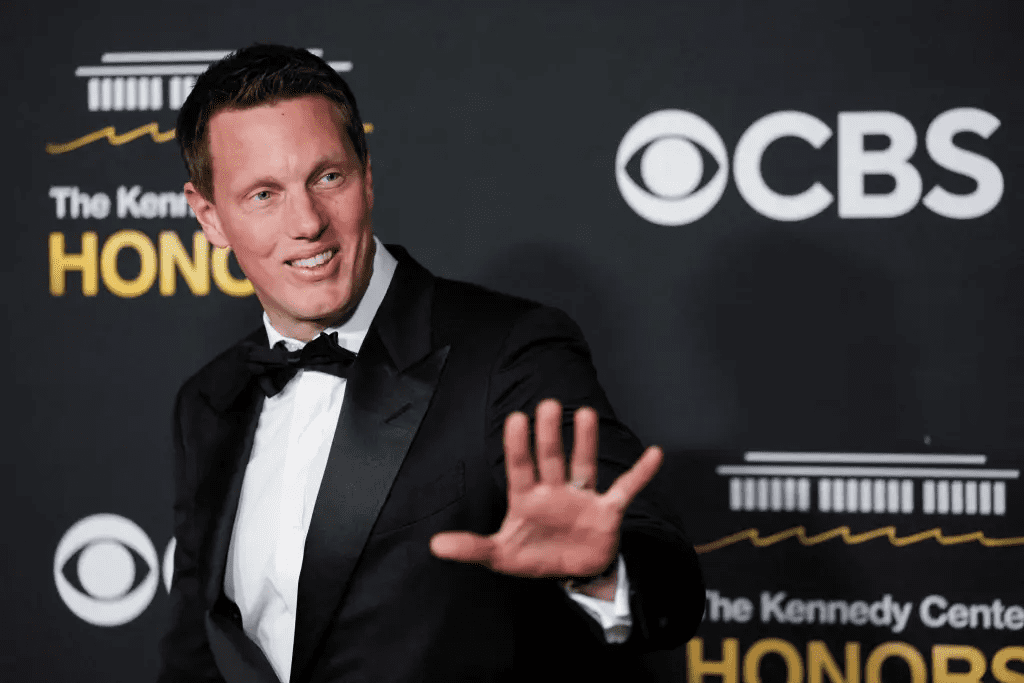

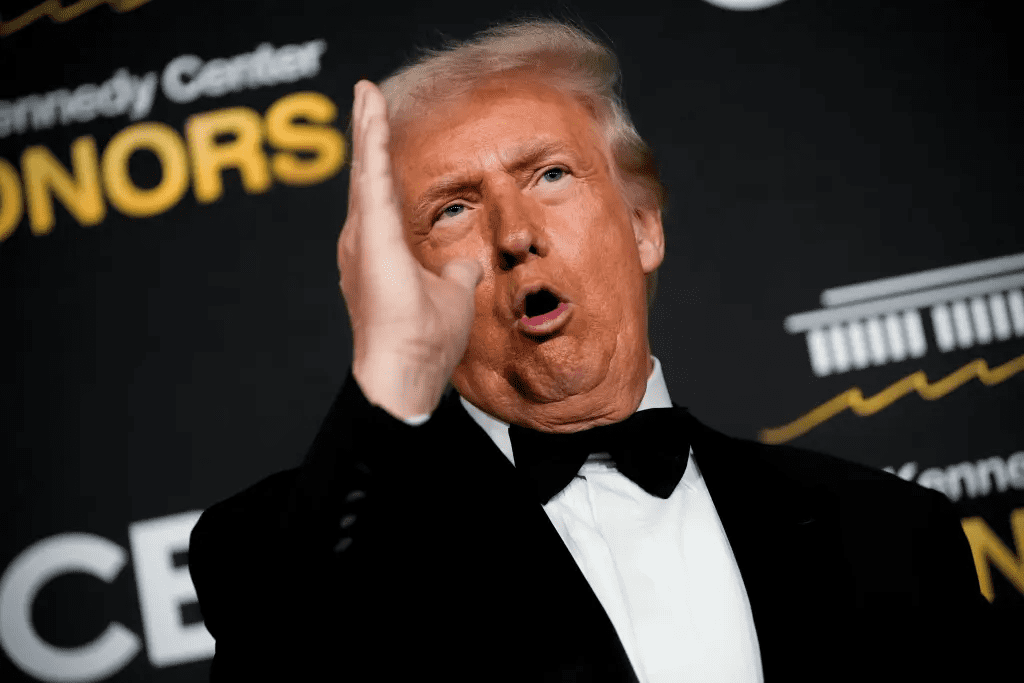

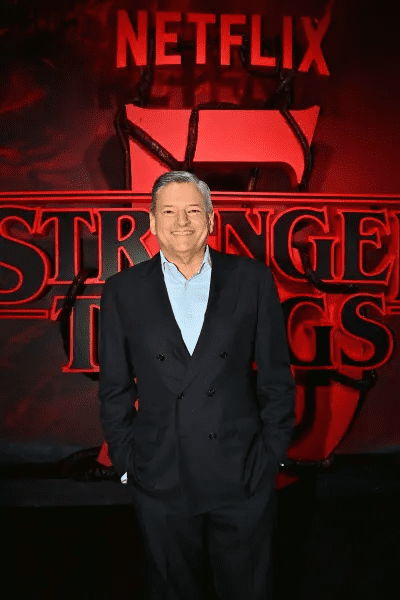

Netflix’s bid, unveiled December 5 in a surprise dawn filing with the SEC, stunned Hollywood with its scope and speed, acquiring WBD’s studio, HBO, and HBO Max for $72 billion in cash and stock, but leaving behind broadcast assets like CNN, TNT Sports, and Discovery networks. Netflix CEO Ted Sarandos, in a memo to 13,000 employees that morning, framed it as a “transformational opportunity” to blend HBO’s prestige content with Netflix’s subscriber muscle, promising “more choice and greater value” without immediate bundles or price hikes. “HBO Max will run separately, preserving what fans love,” Sarandos wrote, his words a nod to the 2023 Warner-Discovery merger’s subscriber bleed of 1.2 million after password crackdowns. The deal, valuing the assets at $82.7 billion including debt, excludes linear TV but includes theatrical commitments for Warner films, ensuring cinema releases continue. Sarandos, who met Trump at the White House on December 1, left with “fantastic” impressions, per Bloomberg sources, but the president aired concerns December 7 on the Kennedy Center red carpet: “That’s got to go through a process, and we’ll see what happens… I’ll be involved in that decision, too.” Trump’s caveat, consulting “some economists,” hints at antitrust scrutiny, with the DOJ and FTC poised to review market concentration—Netflix’s 280 million subs plus HBO’s 100 million could dominate 60% of streaming, per Nielsen data.

The mergers’ frenzy, a whirlwind of term sheets and tender offers, has left Hollywood’s creative class in a state of wary anticipation, their livelihoods hanging on deals that could consolidate power or crush competition. For 38-year-old screenwriter Lena Vasquez, whose script for a HBO Max series on immigrant stories was greenlit in October 2025, the Netflix bid brings uncertainty: “HBO’s the home for nuanced tales—will Netflix’s algorithms favor blockbusters over my quiet drama?” Vasquez asked in a December 6 coffee shop chat in Silver Lake, her notebook open to scene notes as rain pattered against the window. Vasquez, a second-generation Mexican-American whose family tales inspired her work, fears the loss of HBO’s prestige arm, which produced 25% of Emmy winners in 2024. “It’s not just jobs—it’s the space for stories like mine,” she added, her voice soft with the passion of someone who’s balanced barista shifts with writing fellowships. The WBD rejection of Paramount’s initial bid on November 30, calling it “inadequate,” opened the door for Netflix’s aggressive play, but Ellison’s hostile counter—backed by RedBird’s $5 billion commitment—escalates the stakes, potentially dragging the process into 2026 FCC reviews.

WBD CEO David Zaslav, whose 2022 merger of WarnerMedia and Discovery created a $40 billion behemoth, has navigated the courtship with the pragmatism of a dealmaker who’s seen empires rise and fall. “We’re focused on delivering value to shareholders,” Zaslav told investors in a December 6 earnings call, his tone measured as he noted the Netflix offer’s “strategic merits” but Paramount’s as undervalued. Zaslav, 65, a former Discovery exec whose cost-cutting slashed 4,000 jobs and delayed Batgirl’s release, faces pressure from a stock down 30% since the merger amid streaming losses of $1.5 billion in 2024. The Netflix deal’s exclusion of linear TV preserves CNN’s independence but bundles HBO Max with Netflix’s service, a move Sarandos promises won’t hike prices immediately but could evolve into tiers by 2027. Anonymous film producers, in a December 7 letter to Congress, voiced “grave concerns” about a streamer swallowing a theatrical giant, fearing fewer cinema slots for indies. “WBD’s studios are the lifeblood of movies—Netflix’s grip could choke that,” one producer told Variety anonymously, their worry a quiet undercurrent in a town where 70% of films lose money, per MPAA data.

Trump’s involvement, as antitrust enforcer via the DOJ and FTC, adds a political layer to the corporate chessboard, his “problem” comment on December 7 at the Kennedy Center drawing laughs but underscoring his sway. “It’s a lot of market share, so we’ll have to see,” Trump said to reporters, his casual aside hinting at reviews under the Clayton Act’s merger guidelines, which flag deals over 30% concentration. Sarandos, fresh from the White House lunch, told CNBC December 8 the meeting was “productive,” but insiders note Trump’s economists flagged risks to competition. Sen. Elizabeth Warren, D-Mass., called it an “anti-monopoly nightmare” in a December 6 tweet, her Consumer Financial Protection Bureau poised to scrutinize. The European Commission, reviewing under Article 101, could delay until mid-2026, with fines up to 10% of revenue for anticompetitive bundling.

The mergers’ human stakes ripple through Hollywood’s creative veins, from Vasquez’s scripts to Zaslav’s boardrooms. For producers signing the letter, it’s a fear of fewer chances; for Sarandos’ team, it’s a dream of scale. Ellison’s bid, a family legacy play, offers continuity: “Warner’s stories belong in theaters, not just streams,” he told CNBC, his vision a nod to his father’s tech empire. As bids fly and regulators weigh in, the saga stands as Hollywood’s crossroads—a moment where deals define destinies. For Vasquez over coffee, Zaslav in calls, and Trump at galas, it’s a chapter of chance—a gentle reminder that in entertainment’s grand reel, mergers merge not just companies, but the dreams we all share.