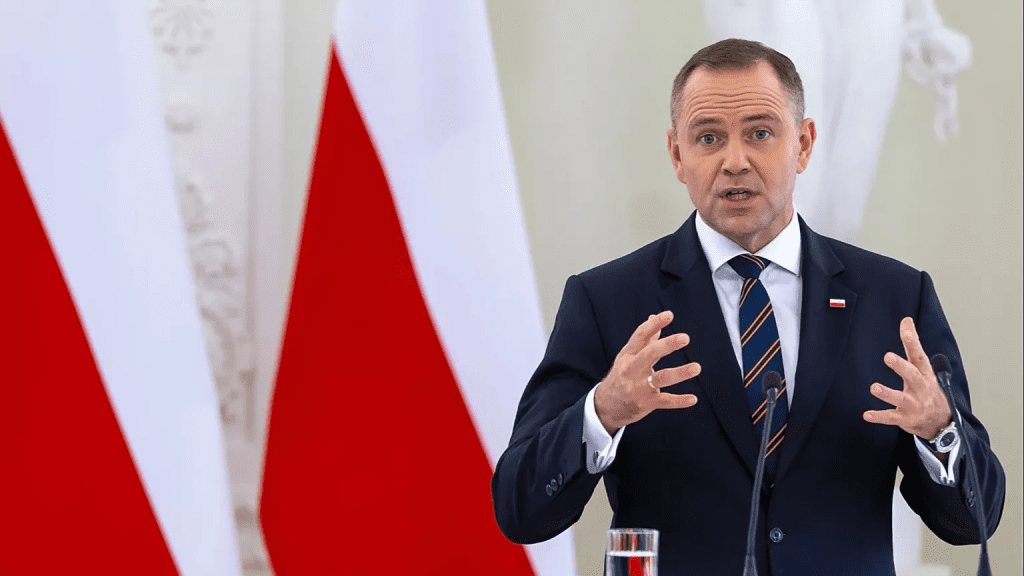

New Law in Poland: President Karol Nawrocki Exempts Many Parents of Two or More Children from Income Tax — A Game-Changer for Families

In a move that has drawn attention across Europe, Poland’s newly inaugurated President Karol Nawrocki has signed into law a sweeping tax reform that grants zero personal income tax (PIT) to parents raising at least two children — so long as their income does not exceed 140,000 zlotys. The legislation, passed on October 16, aims to ease the financial burden on Polish families and spark debate about whether similar policies could take root elsewhere.

The law was a cornerstone of Nawrocki’s campaign, part of what he called his “tax armour” agenda. In August, he introduced the bill to parliament, promising that families would be significantly better off under his leadership. With this reform in place, a middle-income Polish household that previously paid income tax could now see that cost wiped out — provided their annual earnings stay below the 140,000 zloty threshold (roughly €32,973).

The government estimates that many families will gain on the order of 1,000 zlotys per month in extra disposable income under the new rules. But economists caution that the benefits will skew toward households that were already paying significant income tax — those on the lowest end may see only modest gains or none at all if they were already below taxable thresholds.

Some observers point out that the new measure follows the style of pro-family relief seen in other right-leaning governments, especially in Central and Eastern Europe. Nawrocki’s vision blends nationalism with social incentives: by rewarding families, his administration bets on long-term demographic and political returns.

But the reform is not without critics. Tax specialists warn the government will need to plug significant holes in the budget, estimating that closing the revenue gap will require tough financial adjustments elsewhere. Others argue that such large tax breaks may disproportionately benefit the upper middle class more than low-income families who currently pay minimal or no income tax.

Still, the political symbolism is powerful. Nawrocki made zero PIT one of his earliest acts as president, formally signing the bill soon after taking office and pushing the reform agenda hard as a living promise to his voters. It’s a direct appeal to families feeling squeezed by cost of living pressures — a signal that his administration intends to put dependents and domestic life at the heart of governance.

Internationally, the move is being watched closely. Supporters in conservative and pro-family circles abroad have heralded it as a blueprint for balancing economic growth and social policy. Critics, however, emphasize the risk of public finance strain and inequality. Could the United States or other Western nations look to Poland’s experiment and replicate similar tax incentives? The idea is gaining traction among legislators who already favor expanded child tax credits and family allowances.

For Polish parents, the impact is immediate: peace of mind. With more money in hand, families can better juggle education costs, childcare, housing, and savings. The reform isn’t just about numbers — it touches on dignity, stability, and hope in an era of uncertainty.

But the real test will come when budgets are balanced, inflation bites back, and the political footprints of this choice are measured. Will resentments emerge between beneficiaries and non-beneficiaries? Will Poland sustain necessary state services under reduced income tax revenue? Will the socially conservative message deepen divides in an already polarized landscape?

As the 2026 tax year looms, the law’s true winners and losers will become clearer. For now, the story is one of bold ambitions, of a president keeping his word, and of families across Poland waking to a heavier wallet — at least for those who meet the criteria.