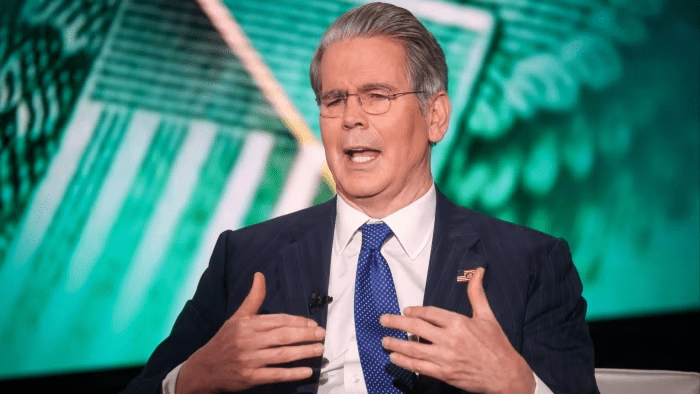

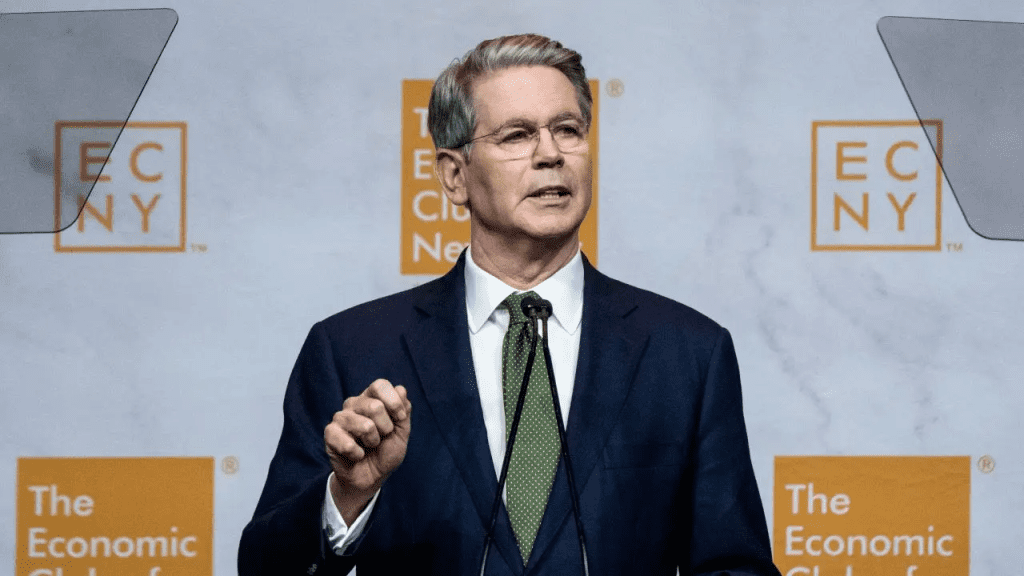

Treasury Secretary Scott Bessent Launches Explosive $9 Billion Fraud Investigation, Backed by Elon Musk and Vivek Ramaswamy’s DOGE Task Force

Washington was already bracing for a shake-up, but few expected this. Treasury Secretary Scott Bessent has unleashed a sweeping investigation into what could be one of the largest federal contract fraud cases in recent history — a stunning $9 billion web of alleged waste, shell firms, and manipulated procurement bids. The probe, triggered by undercover reporting from investigative journalist James O’Keefe, signals that the Trump administration’s second-term economic team is moving aggressively on its signature promise: drain the swamp, one audit at a time.

The move marks the first major test of the newly established Department of Government Efficiency, or DOGE — a joint initiative between Bessent, Elon Musk, and entrepreneur Vivek Ramaswamy. The group’s goal: expose entrenched bureaucratic waste, modernize oversight systems with AI auditing, and recover taxpayer funds siphoned off through decades of “business-as-usual” Washington contracting. “This isn’t political theater,” Bessent told reporters during a brief appearance at Treasury headquarters on Thursday afternoon. “This is about accountability, transparency, and results. Every dollar matters.”

For Bessent, a hedge-fund billionaire turned fiscal reformer, the announcement represents the culmination of months of quiet groundwork. Insiders say the Treasury’s internal watchdog began tracking irregularities earlier this summer after whistleblowers flagged procurement inconsistencies tied to federal infrastructure and green-energy contracts. When O’Keefe’s Project Veritas team released hidden-camera footage allegedly showing contractors discussing bid-inflation practices and kickback arrangements, the evidence forced Treasury’s hand. Within 72 hours, Bessent authorized an internal task force and greenlit coordination with the Justice Department and Office of Inspector General.

According to preliminary documents, investigators are tracing funds across at least four departments, including Energy, Transportation, and Housing & Urban Development. At issue are multi-year contracts that ballooned by as much as 400 percent over their original bids — often justified by “supply chain disruptions” or “environmental compliance” adjustments. But digital forensics, aided by Musk-developed ledger-tracking software now piloted under DOGE, reportedly found recurring payment loops between the same subcontractor networks, suggesting what one Treasury official called “systemic collusion hidden in bureaucratic code.”

The political reverberations have been immediate. Supporters of the Trump-Bessent economic agenda hail the move as proof that the new Treasury team isn’t afraid to confront decades of bipartisan negligence. “This is the first real audit Washington has had in 40 years,” Ramaswamy said in a Friday interview. “DOGE is here to end the culture of cozy contracting.” Elon Musk echoed that sentiment online, posting a single word to X: “Accountability.” The post racked up more than 80 million views within 24 hours.

Behind the slogans, however, the stakes are enormous. If the allegations prove true, Bessent’s investigators could uncover the biggest federal fraud exposure since the 2009 stimulus oversight era. That would give the Treasury unprecedented leverage to restructure oversight rules, claw back billions, and demonstrate that the new administration’s populist economics can coexist with rigorous fiscal control. For taxpayers weary of deficits, it’s a message of hope: Washington’s waste may finally be on trial.

Scott Bessent’s rise to this moment has been anything but accidental. Before joining the Treasury, he managed Soros Fund Management and later launched Key Square Group, one of the highest-performing macro hedge funds of the 2010s. Known for his calm, analytical demeanor and relentless data-driven decision-making, Bessent has long warned that unchecked government spending “inflates inefficiency faster than inflation itself.” His appointment by President Trump earlier this year was seen as a signal that fiscal reform would be central to the administration’s 2025 agenda.

Within weeks of taking office, Bessent restructured Treasury’s auditing pipeline, integrating AI monitoring tools and real-time contract tracking dashboards. Under the DOGE framework — a Musk-inspired acronym that doubles as a viral symbol of government innovation — these systems cross-check federal payments against vendor identities and blockchain-verified compliance records. The aim: make corruption technologically impossible. Early results were promising; in September, the Treasury flagged $117 million in duplicate disbursements before they left federal accounts. Thursday’s $9 billion probe, however, moves that effort into uncharted territory.

The investigation’s scope also carries political weight. The alleged fraud spans contracts issued under multiple administrations, meaning blame will likely cross party lines. While Bessent emphasized that “no one is above scrutiny,” the move puts his department in the center of Washington’s fiercest debate: whether reform is possible without partisanship. Democrats have cautiously welcomed the inquiry, framing it as an overdue review of the federal procurement process, while conservative allies praise the boldness of holding “career bureaucrats” accountable. “This isn’t about punishing one side,” Bessent reiterated. “It’s about protecting Americans who actually pay for all of this.”

In many ways, this moment also reflects the changing face of transparency in government. For decades, investigative journalism and formal oversight worked in parallel, often clashing over access or timing. But this case shows what happens when those worlds align. O’Keefe’s footage, Musk’s technology, Ramaswamy’s reform agenda, and Bessent’s Treasury muscle have converged into a rare hybrid — an alliance of politics, technology, and public outrage aimed squarely at systemic waste. It’s an approach critics call theatrical but supporters view as revolutionary.

Inside Washington, the mood is tense but electric. Treasury staff describe late-night calls, encrypted data transfers, and multi-agency briefings that stretch past midnight. One senior aide told reporters that Bessent has taken personal control of the review process, demanding daily updates from forensic accountants and cyber-investigators. “He’s running this like a Wall Street audit, not a government committee,” the aide said. “Every number has to line up. Every invoice must make sense.” That precision has already unearthed anomalies — including multi-million-dollar payments to shell vendors linked to overseas intermediaries. The Justice Department is reportedly preparing subpoenas as early as next week.

The broader public response has been striking. Conservative commentators on X and Truth Social hailed Bessent as “the new face of fiscal patriotism,” drawing comparisons to Trump’s early 2017 push to slash regulatory red tape. Across talk radio and evening cable, the narrative is clear: this is Washington finally being held to the same standard as the taxpayers who fund it. Even some traditionally skeptical voices, including moderates within the financial press, admit that Bessent’s initiative could redefine how federal oversight operates in the AI era.

Yet beyond the politics and praise, there’s also a sober undercurrent. Experts warn that rooting out $9 billion in potential fraud won’t be easy. Contractual law, multi-year payment schedules, and bureaucratic inertia make accountability complex. But few doubt Bessent’s resolve. Former colleagues describe him as “methodical to the point of obsession.” A senior Treasury inspector put it more bluntly: “He’s the kind of guy who finds the missing $1 on page 403 of a 10,000-page spreadsheet. People like that make enemies — but they also get results.”

For President Trump, the probe arrives at a politically opportune moment. With mid-term momentum building and public concern over inflation giving way to demands for efficiency, the White House is eager to showcase tangible reform. The DOGE initiative has quickly become a rallying cry among populist Republicans, symbolizing a fusion of innovation, accountability, and nationalism. “We’re not just cutting taxes,” Trump said at a rally in Tampa last week. “We’re cutting waste — and they hate that.” The crowd’s roar underscored how much fiscal vigilance has become part of the movement’s identity.

As the story develops, the Treasury’s investigation could set the tone for the rest of the administration’s economic strategy. If successful, it will not only recover billions but also prove that modern technology and political will can finally outsmart bureaucratic decay. For now, Washington is watching — nervously, perhaps, but with a sense that something different is happening. A government long accused of bloat and corruption is being forced to audit itself, and the man holding the calculator is a billionaire banker who once managed George Soros’s fortune.

Scott Bessent’s crusade is more than a headline — it’s a statement about the era we’re entering. Precision over politics. Accountability over excuses. Technology over tradition. Whether you see it as reform or revolution, one fact is undeniable: Washington hasn’t felt this nervous in years. And if DOGE delivers on its promise, that nervous energy may soon turn into the biggest federal reckoning of the decade.