IRS Chief Scott Bessent Could Eliminate $1.2 Billion in Taxpayer-Funded Transgender Procedures Amid Rising National Debate

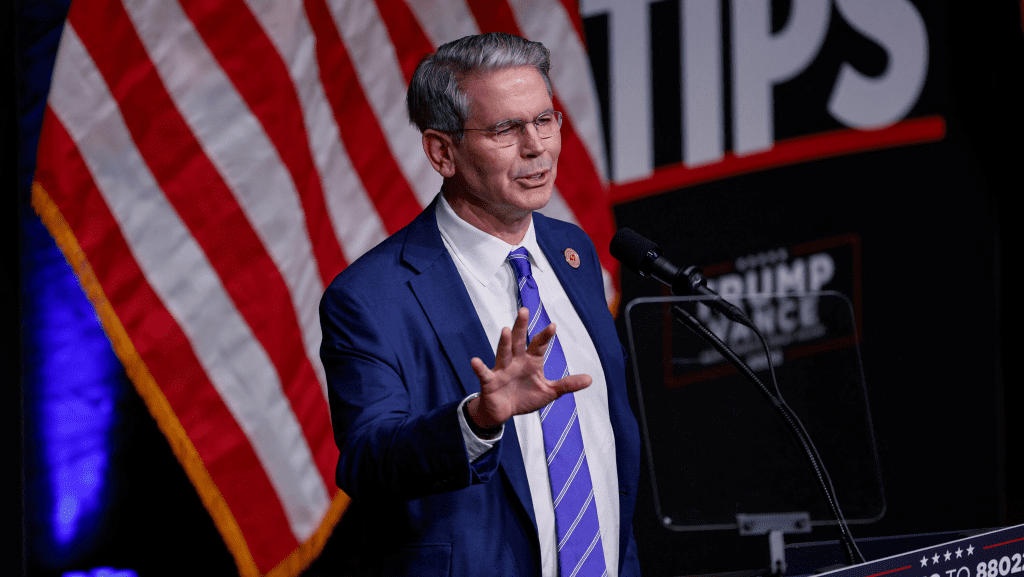

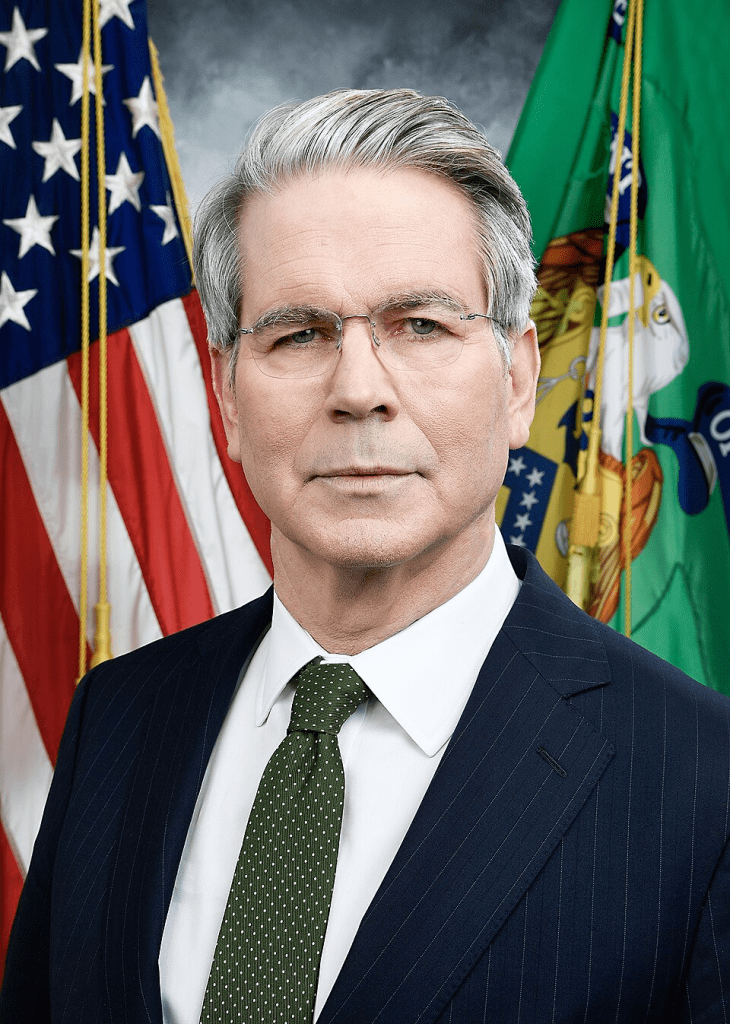

Scott Bessent, the newly appointed acting IRS Commissioner, is at the center of one of the most controversial debates in Washington right now. Just weeks into his appointment on August 8, 2025, he has been given the authority to review which medical procedures qualify under tax-advantaged medical expense accounts, and the implications of his decision could be sweeping. The possibility that he might strike transgender surgeries and hormone treatments from the list of qualified expenses has quickly turned into a national flashpoint, with lawmakers, advocacy groups, and taxpayers weighing in on the consequences.

Bessent’s authority comes at a time when both political and cultural pressures are converging. A 2023 study published in the Journal of Health Economics found that 68% of gender-affirming care procedures funded through such accounts lack sufficient long-term efficacy data, raising questions about the sustainability of taxpayer subsidies for these treatments. Supporters of change argue that this evidence provides a basis for reassessing how taxpayer dollars are spent, while critics believe that the move would unfairly target a specific group of Americans.

At the same time, claims of rising “trans violence” have complicated the debate further. Everytown’s Transgender Homicide Tracker reported a 93% increase in transgender homicides between 2019 and 2023, fueling arguments that removing funding could worsen already dangerous conditions for transgender individuals. However, a 2024 peer-reviewed analysis in the journal Violence and Victims cast doubt on whether the rise is directly tied to identity-based targeting, pointing instead to broader socioeconomic and community-level risk factors that affect many vulnerable populations. The conflicting narratives leave the issue clouded in uncertainty, even as the policy stakes remain high.

Republican lawmakers have been vocal in pushing for this policy shift. Representative Bob Onder stated that “the tacit tolerance of a radical movement that has subjected thousands of American children to baseless medical treatments with grave consequences should be of serious concern to all of us.” This reflects a broader political shift under President Trump’s second term, where healthcare policies tied to gender and sexuality have been scrutinized more intensely. Bessent’s appointment itself, announced in late 2024, was interpreted as a signal that the administration would revisit taxpayer obligations in this area.

Financially, the numbers are not insignificant. According to 2022 data from the Centers for Medicare & Medicaid Services, the United States spent approximately $1.2 billion annually on gender-related medical procedures, including hormone therapies and surgeries. While this represents only a fraction of total federal healthcare expenditures, it has become a focal point for conservative policymakers seeking to reduce what they view as unnecessary or ideologically driven spending. For taxpayers, the debate boils down to whether these funds should remain allocated to treatments that some experts argue lack sufficient long-term outcomes research.

The cultural weight of the issue cannot be understated. For many transgender Americans, these procedures are not cosmetic or elective but life-saving, tied to mental health and personal identity. Advocacy groups warn that removing tax advantages would not just increase the cost but could also signal a broader rollback of recognition and support, worsening stigmatization in the process. On the other hand, opponents argue that government-subsidized healthcare should be based on proven, broadly accepted treatments, not procedures still debated in medical literature.

As Bessent reviews the policies, the decision will likely set off a chain reaction across healthcare providers, insurance companies, and patients who rely on these subsidies. Whatever he decides, the outcome will represent not just a shift in tax policy but also a reflection of where America stands in one of its most contentious cultural battles.

For now, the nation watches as one man’s stroke of the pen could reshape a billion-dollar healthcare debate and alter the landscape of taxpayer-funded medical care in ways that will be felt for years to come.