President Trump Promises at Least $2,000 “Tariff Dividend” to Most Americans — Labels Tariff Opponents “FOOLS!”

On the morning of November 9 , 2025, Donald Trump made a sweeping announcement that sent ripples through Washington and across American households: using tariff-revenues from his trade policies, he promised a payment — a so-called “tariff dividend” — of at least $2,000 per person to nearly every American, excluding only high-income earners.

Trump posted on his platform Truth Social, declaring: “A dividend of at least $2000 a person (not including high income people!) will be paid to everyone.” He followed that with a sharp jab: “People that are against Tariffs are FOOLS!”

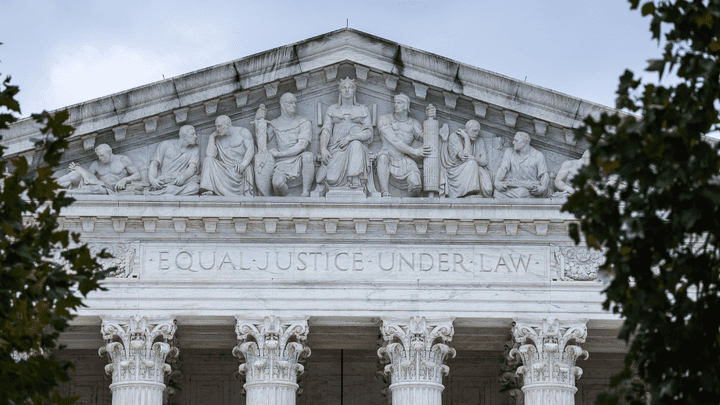

The timing could hardly be more dramatic. His pledge comes as the Supreme Court of the United States weighs the legality of his sweeping tariffs, many imposed under the International Emergency Economic Powers Act (IEEPA), after lower courts ruled the tariffs exceeded his authority.

From the Rose Garden in April of this year, Trump declared “Liberation Day,” unveiling a broad new tariff regime, invoking a national emergency to justify fresh duties. Now the question turns to how those duties can be translated into direct relief for citizens — and whether Congress, the courts, and Americans are ready.

In his post, Trump framed the narrative: the United States is “taking in Trillions of Dollars” through tariffs, he said, and soon will begin “paying down our enormous $37 trillion debt.” Earlier this year, he floated that a distribution or a “dividend” could be made to middle- and lower-income Americans out of tariff receipts.

But as bold as the promise is, the path to delivery remains murky. Officials have not outlined the mechanism, eligibility criteria beyond income limits, the timing of payments, or whether any legal or legislative gate-keeps will apply. Analysts caution the dividend hinges on both the legal standing of the tariff regime and congressional approval to redirect those funds.

Under Trump’s argument, tariffs are not simply trade policy — they are economic tools to fund citizen relief and revive American manufacturing. He emphasized that critics of tariffs were “FOOLS,” and claimed manufacturing plants were springing up “all over the place,” 401(k)s were at record highs, and inflation was virtually nonexistent under his leadership.

Yet some economists urge caution. While the Treasury’s 2025 customs-duty report shows several hundred billion in tariff revenue, converting that into a mass payment program would require a massive shift in budget priorities — and legal clarity. One estimate puts the 2025 tariff haul at about $195 billion before the fiscal year’s end.

The Supreme Court’s looming decision casts a large shadow. Should the Court decide that the tariffs were improperly imposed under the national-emergency statute, refunds could be demanded and the funding base under the promised dividend could evaporate. Axios reported that justices appeared concerned about whether the tariffs acted as disguised taxation rather than legitimate emergency trade action.

From the perspective of Americans feeling squeezed by rising living costs, the promise of a $2,000 payment hits at raw emotion: a direct cash infusion tied to economic recovery, patriotic manufacturing revival, and a reset of what many see as a rigged global trade system. If executed, it could transform public perception of economic policy — from distant trade-talk to personal payout.

Supporters of Trump see this as a bold re-imagining of the social contract: tariffs not as burdens on consumers, but as direct returns from American leverage over trade relationships. They point to the historical narrative of “foreign countries taking advantage of us,” and see the dividend as tangible reparation. To them, the message is clear: “We will win, and you will benefit.”

Detractors, however, raise pointed critiques: If tariffs raise prices for consumers, as many economists warn, then the dividend could just offset but not overturn the inflationary cost. Moreover, shifting trade-revenues into direct checks may fundamentally alter how federal budgets operate — bypassing the usual taxation and appropriations processes and raising questions about separation of powers and fiscal discipline. The legal challenge is not academic: President Trump’s tariff regime is currently defended as trade-balance policy, but opponents argue it is effectively revenue raising, which the executive branch cannot unilaterally impose.

Behind the scenes, Treasury Secretary Scott Bessent has emphasized that the goal of tariffs is “to rebalance trade,” not simply to raise revenue, leaving some ambiguity as to whether those funds can legally flow to citizens as a “dividend.”

Politically, this proclamation is a high-stakes move. For Trump, it plays to his signature strengths: decisive leadership, bold economic change, and direct appeals to “ordinary Americans.” If successful, it could bolster his standing among populist voters and set a precedent for future conservative economic policy. If it stalls or falters, the spectacle could reinforce critiques of overreach and fiscal recklessness.

For the broader electorate, the idea of receiving a $2,000 check funded through American tariffs is emotionally and symbolically powerful. It marries nationalism (we are getting stronger), economic populism (you get paid), and trade policy (tariffs finally yield results). It reframes import duties not as abstract policy, but as citizen benefit. And in a climate of economic insecurity and political upheaval, that message resonates.

Yet the delivery will determine public perception. A delayed payment, unclear eligibility, or legal roadblocks may breed cynicism or frustration. Voters may ask: who qualifies exactly? How will high-income exclusions be defined? Will the payments happen before next year’s tax season? Will the payments outpace any price inflation linked to tariffs? These practicalities cannot remain undefined very long.

Financial markets, too, may watch closely. Tariff policies impact supply chains, prices, corporate profits, and global trade flows. Embedding a dividend promise within that web adds a layer of expectations: that tariff revenues will exceed forecasts and that the government will channel them into checks rather than deficit spending or regulatory shifts. Some investors may cheer the potential boost to consumer cashflow; others may worry about inflation or budget instability.

Viewed historically, the move echoes past administrations’ stimulus payments, but with a distinct difference: this is not a tax refund, direct stimulus tied to an economic crisis, or a universal basic income pilot — it’s a mainstream conservative figure linking tariffs, trade policy, and citizen payout. That makes it an unusual hybrid of trade-war rhetoric and direct welfare-style benefit. Only time will show if it becomes a template.

As Americans across the income spectrum digest the announcement, media outlets and policymakers will be watching for several key developments: the release of official eligibility criteria, the timing of the first payments, the reaction from Congress (which must likely approve the funding mechanism), the response of legal authorities, and whether inflation or consumer-price shifts dampen the payout’s impact. Each of these variables could amplify or undermine the initial promise.

In the end, the significance of the announcement may rest not only on whether people receive the money, but on whether it changes how Americans view trade policy and economic leadership. If a $2,000 dividend becomes real, it could cement Trump’s narrative of economic nationalism paying off for citizens. If it falters, the gap between rhetoric and reality may become a liability.

For now, the message is bold, direct, and emotionally charged: from the corridors of policy and power to the mailboxes of ordinary Americans, President Trump is seeking to deliver payoff from tariffs. Whether the idea becomes action remains to be seen — but the promise alone has already reshaped the conversation.