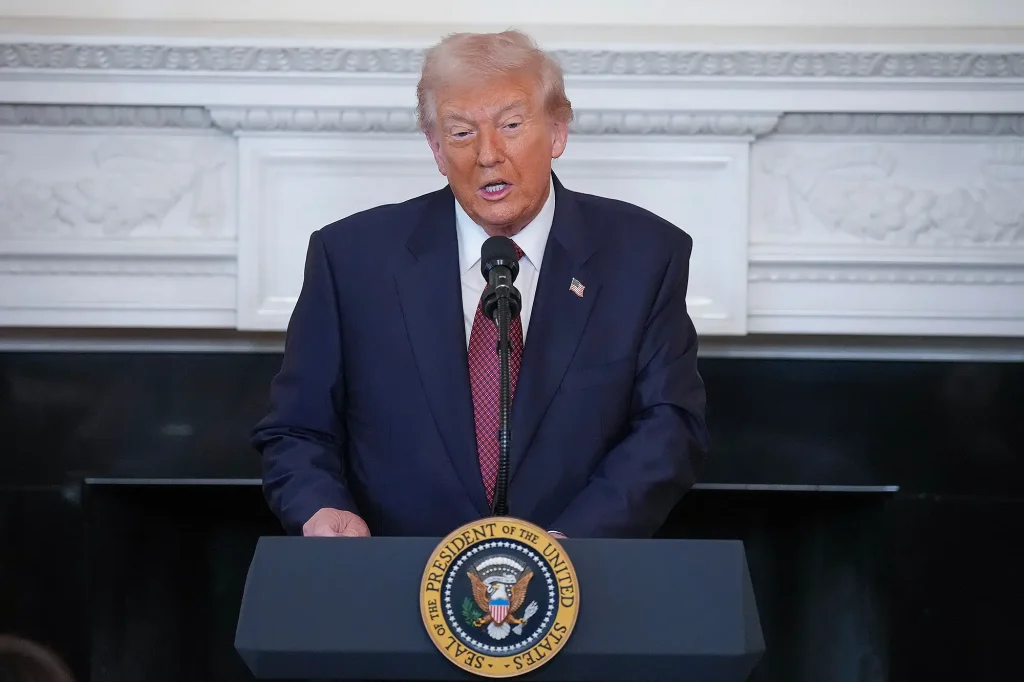

Donald Trump Announces $2,000 Tariff Dividend for Americans — Says Payments Will Come From Tariff Revenues, Critics Call It Economically Unrealistic

Former President Donald Trump made a bold new economic claim this week, declaring that most Americans will soon receive what he calls a “tariff dividend” of at least $2,000, funded directly from the tariffs imposed on imports under his trade agenda. The statement, posted Sunday on his Truth Social account, reignited debate over the role of tariffs in Trump’s economic strategy and raised questions about whether such payments could realistically be made.

Trump’s message was characteristically confident. “People that are against tariffs are FOOLS! We are now the Richest, Most Respected Country in the World,” he wrote, insisting that his policies had strengthened America’s economy while keeping inflation low. He claimed that revenues from tariffs — taxes paid by importers on goods entering the United States — would be used to fund direct payments to citizens, which he described as a dividend rather than a government handout. “A dividend of at least $2,000 a person (not including high-income people!) will be paid to everyone,” Trump said.

The post quickly gained attention, with both supporters and critics weighing in. His base viewed the announcement as another example of Trump’s populist focus on putting “America First,” while economists and policy experts urged caution, noting that such a program would be nearly impossible to fund at the level described.

To understand the claim, it’s important to look at how tariffs work. When the U.S. government imposes tariffs on foreign goods — such as steel, electronics, or automobiles — importers are required to pay those taxes, which often translate into higher prices for American consumers. The money collected goes to the U.S. Treasury, becoming part of federal revenue. Trump’s proposal suggests that this revenue could be redistributed directly to Americans as a form of “dividend” — similar in concept to how Alaska shares oil revenue with residents through an annual payment.

However, economists immediately raised concerns about the math. Treasury Department data shows that the federal government collected around $195 billion in tariff revenue between January and September 2025. Dividing that figure among roughly 170 million eligible American adults would result in less than $1,200 per person, and that’s before accounting for existing federal obligations and administrative costs. In short, the funds fall far short of what Trump is promising.

Treasury Secretary Scott Bessent, speaking on ABC’s This Week following Trump’s announcement, said that the “tariff dividend” could take various forms beyond direct payments. “It could come in lots of ways,” Bessent said, mentioning potential options such as tax credits or cuts for workers and families rather than physical checks. That clarification left many wondering whether the $2,000 figure was more symbolic than literal — an aspirational talking point rather than a formal policy.

Critics from both sides of the political aisle noted that Trump’s rhetoric often mixes economic populism with bold generalizations. Tariffs have long been a cornerstone of his trade philosophy, and he’s defended them as essential to rebuilding American industry and protecting domestic jobs. But economists argue that tariffs can also raise prices for consumers and complicate global supply chains. “Tariffs aren’t paid by foreign countries,” one trade analyst explained. “They’re paid by American importers, and ultimately by shoppers.”

Still, Trump’s framing of the plan as a “dividend” resonated with his supporters, many of whom see tariffs as a patriotic tool for strengthening America’s economy. By suggesting that Americans would directly benefit from those tariffs, Trump’s message blended financial incentive with nationalist pride — a hallmark of his political style. His choice of the term “dividend” also evoked a sense of ownership, implying that the public, not corporations or elites, deserved a share of the country’s economic gains.

The announcement quickly made headlines across major networks, with outlets such as People, The Guardian, and ABC News covering the claim and its implications. The Wall Street Journal described the move as “a mix of economic populism and political showmanship,” while The Guardian emphasized the uncertainty surrounding implementation, quoting policy experts who said Congress would likely need to authorize any such payments.

In Washington, reactions were split. Republican lawmakers closely aligned with Trump praised the idea as an innovative way to return value to American workers. “Tariffs make America stronger,” said one conservative member of Congress. “If President Trump wants to share that revenue with our citizens, that’s exactly the kind of leadership we need.” But others within the GOP expressed quiet skepticism, pointing out that such a large-scale distribution could balloon the deficit if not carefully balanced with spending cuts or new revenue streams.

Democrats, meanwhile, dismissed the proposal as unrealistic and politically motivated. One Democratic senator called it “campaign economics disguised as policy,” while others questioned the legality of using tariff funds without congressional approval. The Constitution gives Congress the power of the purse, meaning that even if the administration collected significant tariff revenue, any plan to distribute it as a direct payment would likely require legislation.

Legal analysts also noted that some of the tariffs that underpin Trump’s revenue claims are currently being challenged in court. Several trade groups and importers have filed lawsuits questioning the president’s authority to impose or expand certain duties. If those challenges succeed, they could reduce the amount of tariff revenue available, further undermining the feasibility of the dividend plan.

Despite those hurdles, Trump’s post succeeded in shifting attention toward his trade agenda and reenergizing debate around tariffs as a central feature of his economic platform. For Trump, tariffs are not merely a financial instrument — they’re a symbol of national strength. By framing them as a means to directly reward Americans, he reinforced his populist message of prioritizing domestic interests over global partnerships.

The announcement also came at a politically strategic moment. As Trump continues to dominate Republican politics ahead of 2026, the promise of direct payments could serve as a powerful talking point to mobilize voters. The idea of a $2,000 “dividend” resonates with many Americans still grappling with inflation and stagnant wages. Whether the plan materializes or not, it captures the essence of Trump’s economic messaging: bold, attention-grabbing, and grounded in his image as a businessman fighting for the “forgotten” middle class.

But beyond the politics lies the practical question: could a tariff dividend ever truly happen? Financial analysts say that even if the government wanted to issue such payments, the logistics would be daunting. Tariff revenue fluctuates yearly, and redirecting those funds would require creating new administrative systems and possibly cutting funding from other programs. There’s also the issue of equity — deciding who qualifies as “not high income” and ensuring that payments reach those most affected by rising costs.

While Trump’s critics argue the plan is more of a political stunt than a serious policy, his supporters see it differently. To them, the announcement represents a promise of fairness — that the benefits of America’s economic power should reach ordinary people, not just corporations or bureaucrats. One supporter wrote online, “Trump wants to give us what’s ours. That’s leadership.”

As the debate continues, economists remain divided on the broader implications of Trump’s tariff policy. Supporters credit tariffs with boosting domestic manufacturing and strengthening U.S. leverage in trade negotiations, particularly against China. Opponents counter that the measures hurt consumers and small businesses by raising import costs. The $2,000 dividend proposal adds a new layer to that debate, forcing both camps to reconsider the long-term impact of Trump’s trade vision.

For now, the “tariff dividend” remains a promise without a policy. There are no official documents outlining how the funds would be collected, distributed, or monitored. The Treasury Department has yet to release any framework for such a plan. What remains clear, however, is that the announcement achieved its immediate goal — capturing headlines and reigniting conversation about Trump’s economic strategy just as he seeks to reinforce his dominance on the national stage.

In many ways, this announcement encapsulates Trump’s political style: dramatic, ambitious, and rooted in a vision of America that rewards strength and self-sufficiency. Whether the $2,000 dividend ever reaches Americans’ bank accounts or not, it reinforces the former president’s message — that under his leadership, the nation’s wealth belongs not to Washington, but to the people.