Trump and Scott Bessent plot IRS criminal overhaul to dismantle left-wing funding of Antifa

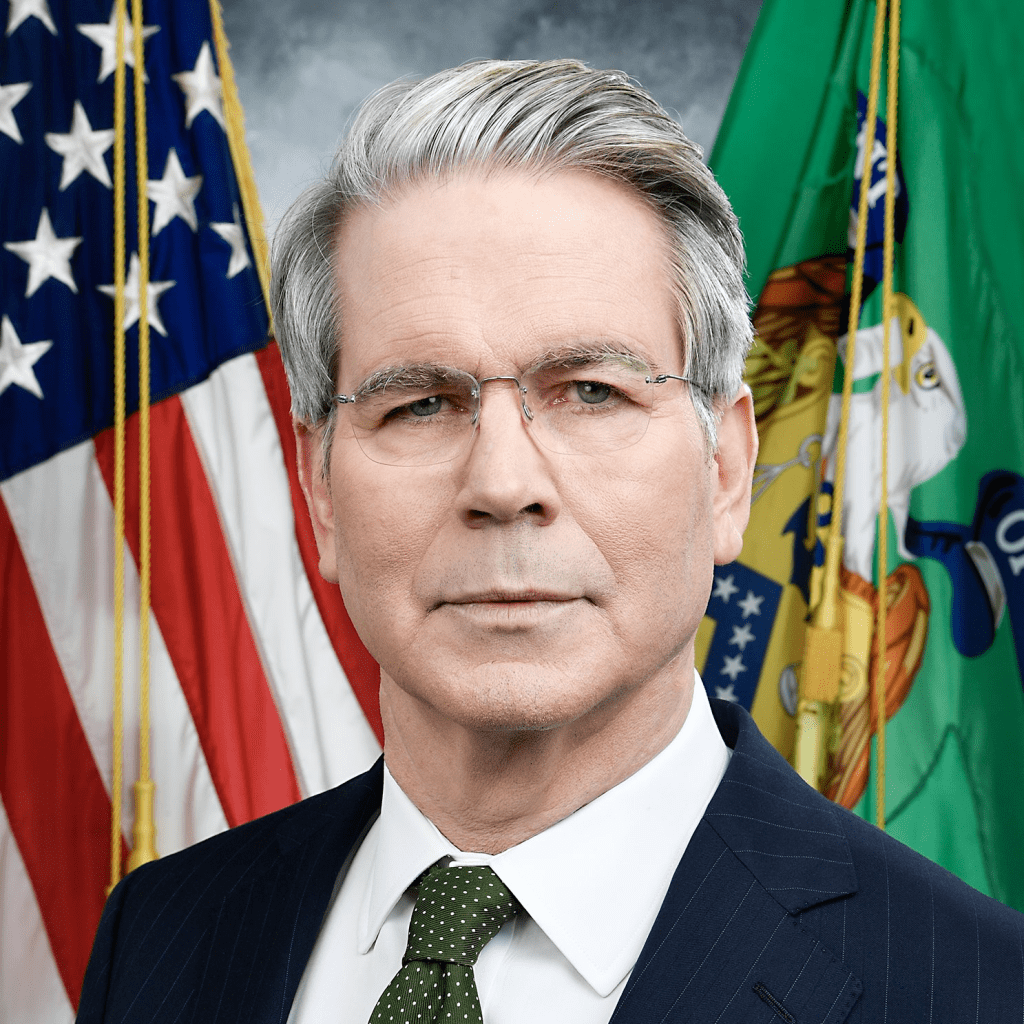

A sweeping new initiative is taking shape behind closed doors in Washington, one poised to recast the Internal Revenue Service as an instrument in the Trump administration’s campaign against left-wing activism. According to a Wall Street Journal report, President Trump and Treasury Secretary nominee Scott Bessent are pushing radical reforms that would strengthen the IRS’s criminal division, sideline traditional oversight, and target the financial arteries of organizations accused of supporting political violence, including Antifa. The plan marks an acceleration of Trump’s long-stated desire to unmask—and dismantle—the funding networks he views as fueling chaos in Democratic-run cities.

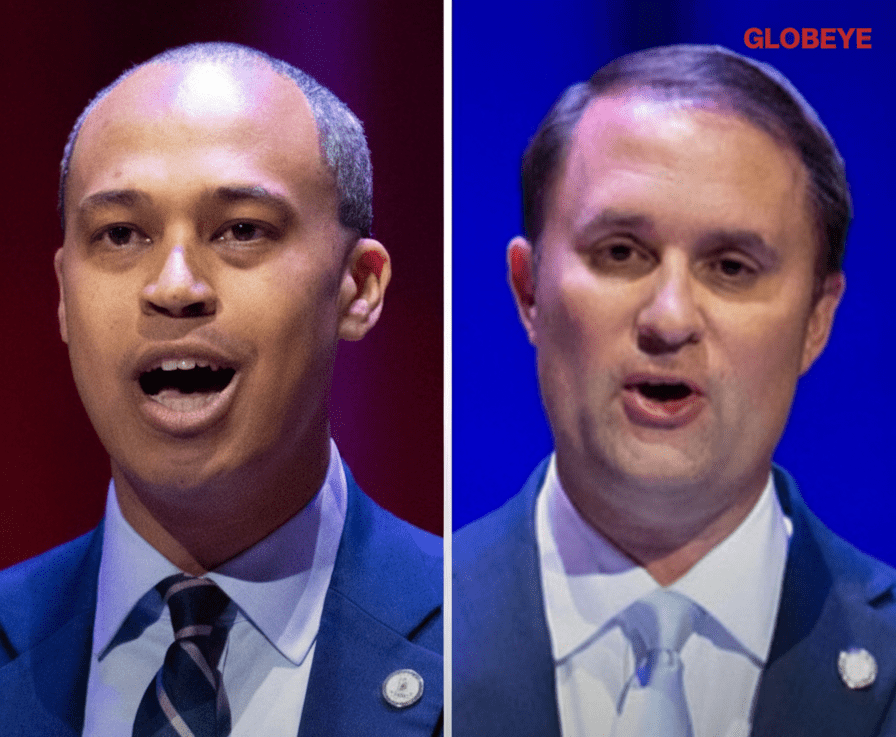

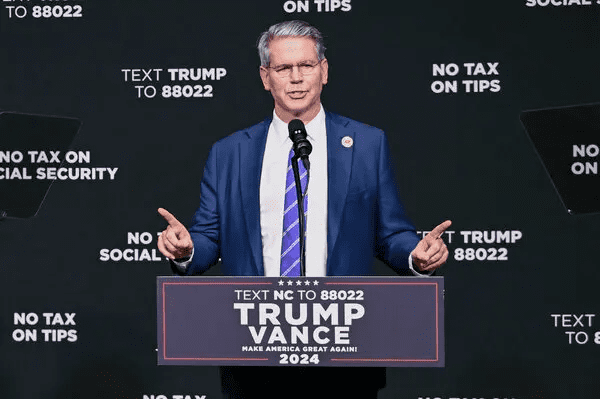

At the core of this strategy is the IRS Criminal Investigation division (IRS-CI). The WSJ says the administration aims to install allies of Trump within that unit and reduce the role of IRS lawyers in criminal case approvals, thereby easing procedural barriers to investigations led by political motive. Gary Shapley, a senior adviser to Bessent, is said to be orchestrating the effort: drafting target lists, pushing for leadership changes, and rewriting internal rules to allow more aggressive actions. Among prospective targets mentioned in the leaks is billionaire donor George Soros and organizations affiliated with him. Supporters call it a bold reclaiming of power; critics warn it may open the door to politically motivated prosecutions.

Trump has been clear about his intent. In cabinet meetings and public remarks, he has made repeated calls to expose what he calls “dark money” fueling unrest. He directed Bessent to make “identifying financial networks” a priority and noted that the move would target those “fomenting political violence.” Officials familiar with the plans say that the enhancements at the IRS align with Trump’s executive order naming Antifa a “domestic terrorist organization.”

Yet the shift represents a dramatic departure from standard practice. Historically, IRS criminal probes require approvals, legal case readiness, and oversight by specialized lawyers to protect against abuses. This plan, according to sources, would curtail that layer of protection. It would empower investigators to pursue organizations and individuals with fewer procedural checks. That transformation raises serious questions about fairness and the potential for overreach.

Supporters argue that the move is necessary to stop what they see as well-funded, well-organized networks promoting violence under the guise of protest. They say the financial side of activism is where power lies, and that attacking it directly is long overdue. For them, the IRS tools have been underutilized in political fights—this is the counteroffensive.

Yet many legal scholars, watchdog groups, and some IRS insiders view the plan with deep concern. They warn that merging law enforcement tools with political objectives risks violating constitutional protections and undermining the independence of tax enforcement. There are fears that innocent nonprofits might be swept into investigations on tenuous grounds, or that political opponents could be targeted. The specter of weaponized taxation is not new, but this proposal pushes that risk to a new level.

The proposal is already drawing blowback. Critics say the abandonment of internal checks and the concentration of control at the top will make the IRS vulnerable to partisan uses. Some IRS lawyers reportedly oppose the plan, arguing that the current system exists to preserve due process and prevent abuse. Others fear that a pendulum swing this broad will erode trust in a body that is supposed to be neutral.

If put into action, the plan would mark one of the boldest realignments of federal power in recent memory. The IRS, often seen as a quiet enforcer of tax laws, would become a central tool in the ideological battlefield. Whether it delivers on Trump’s promise to defund political violence, or becomes a lightning rod for accusations of abuse, remains to be seen.

In the months ahead, eyes will be on Congress, the courts, and the public reaction. Will lawmakers push back? Will civil liberties groups suit up for court? And most importantly: will the IRS become a neutral tax administrator once more, or evolve fully into an instrument of political enforcement?