With Powell’s Term Winding Down, White House Weighs Economic Ally Against Independence Fears in High-Stakes Succession Battle

The crisp December air carried a hint of pine from the National Christmas Tree on the Ellipse as President Donald Trump stepped off Marine One on the South Lawn of the White House on December 10, 2025, his red tie a splash of color against the gray skies, his mind already turning to the week’s most pivotal meetings. It was the start of final interviews for the next Federal Reserve chair, a role that has loomed large since Jerome Powell’s term ends in May 2026, and Trump wasted no time signaling his leanings to reporters trailing him toward the Oval Office. “We’re going to be looking at a couple different people, but I have a pretty good idea of who I want,” Trump said, his voice carrying the confident lilt of a dealmaker closing in on his choice, the words landing like a gentle nudge toward Kevin Hassett, the National Economic Council director who has become the clear frontrunner in betting markets and behind-the-scenes whispers. For Hassett, 63, the Harvard-trained economist who chaired Trump’s first-term Council of Economic Advisers and has advocated for aggressive rate cuts to fuel growth, the interviews represent the culmination of a summer-long audition, a chance to steer the world’s most powerful central bank toward the president’s vision of low rates and tariff-fueled prosperity. As markets jitter with anticipation—futures dipping 0.3% on the news—and economists debate the risks to Fed independence, Trump’s selection evokes a poignant tension: The promise of an economic ally who could deliver cheaper loans and mortgages for families like those scraping by in Cleveland or Phoenix, weighed against the quiet fear of a central bank too closely leashed to the Oval Office, a balance that has defined the Fed’s role since its 1913 founding.

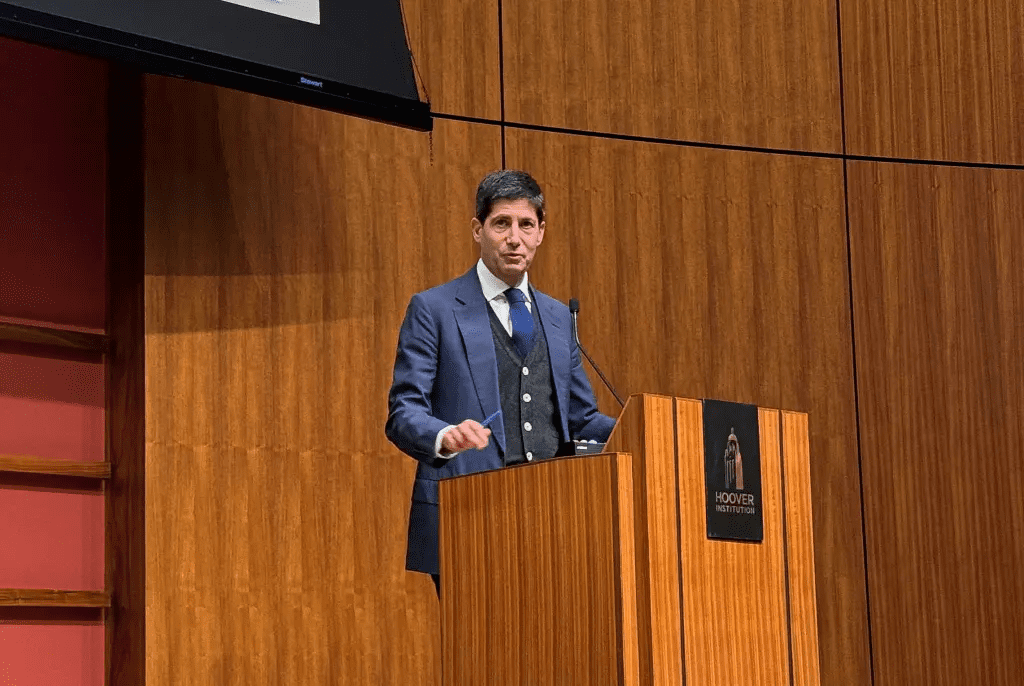

Kevin Hassett’s emergence as the favorite traces to a methodical vetting process led by Treasury Secretary Scott Bessent since July, when Trump first signaled his intent to replace Powell amid frustrations with the Fed’s cautious rate path. Bessent, the former hedge fund manager whose Wall Street savvy has guided Trump’s tariff revenues to a record $215 billion through September, conducted two rounds of interviews with nearly a dozen candidates, narrowing to five: Hassett, former Fed Governor Kevin Warsh, Governors Christopher Waller and Michelle Bowman, and BlackRock executive Rick Rieder. The final sit-downs, starting December 11 with Warsh and including Hassett by week’s end, come after a Bloomberg report on November 25 pegged Hassett at 73% odds on Kalshi markets, his loyalty to Trump—weekly Fox appearances defending low-rate calls—making him a natural fit. “Kevin’s data-driven, but he gets the president’s vision: Rates low enough to let families afford homes, cars, without inflation’s bite,” a White House official told Politico anonymously, the sentiment echoed in Hassett’s November 24 Wall Street Journal interview where he said there is “plenty of room” for cuts if inflation holds below 2%. For 42-year-old real estate agent Maria Lopez in suburban Phoenix, whose $1,800 monthly mortgage has edged up with rates at 4.25%, Hassett’s potential nod feels like a lifeline: “A rate cut means my clients close deals—first homes for their kids. Trump’s pick could make that real.”

Hassett’s track record, a blend of academic rigor and political alignment, positions him as the administration’s economic whisperer, his first-term role crafting the 2017 tax cuts that boosted GDP 2.9% in 2018 per BEA data. A Boston College undergrad and University of Pennsylvania Ph.D., Hassett’s 2006 book “Dow 36,000” predicted market highs that drew mockery but later vindication, his 2017 CEA chairmanship overseeing deregulation that added 6.7 million jobs pre-pandemic. “Kevin’s not a yes-man—he’s a thinker who aligns on growth,” said former CEA colleague Kevin Corinth in a December 3 Bloomberg interview, praising Hassett’s advocacy for 1% rates to counter tariff inflation. Markets, jittery with Fed futures pricing a 75% chance of a December cut, dipped 0.4% on December 2 after Trump’s Air Force One tease, bond yields falling 5 basis points on Hassett’s low-rate signals. But critics like former Fed Governor Lael Brainard warn of independence erosion: “Hassett’s loyalty could politicize the Fed, risking 1970s-style stagflation if rates stay too low,” she said in a December 4 Financial Times op-ed, her words a caution from the Biden-era Treasury secretary who navigated 2022’s 9.1% inflation peak.

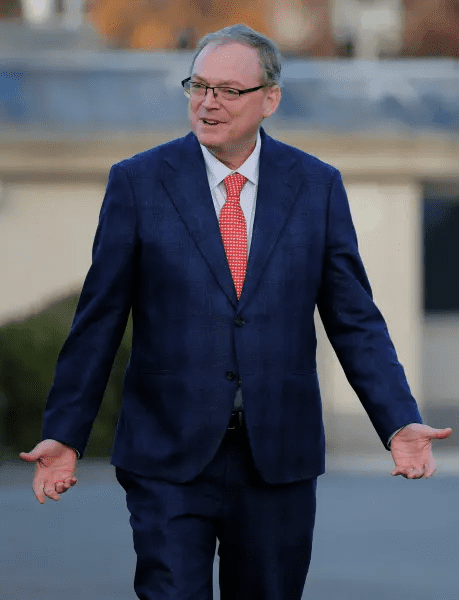

The interviews, conducted by Trump and Bessent in the Oval Office and Situation Room, come amid a Fed divided on policy—Powell’s November 7 speech signaling a December cut but pausing further if jobs hold strong at 4.1% unemployment. Warsh, 55, a Stanford economist and 2006-2011 governor, favors rules-based policy and has criticized Powell’s “data dependence” as vague, his December 11 slot a nod to his hawkish bent. Waller, 64, a current governor with a Ph.D. from Washington University, brings internal continuity, his November testimony supporting gradual cuts. Bowman, 62, Trump’s 2018 appointee, emphasizes regional banks, her re-nomination odds at 15% on Kalshi. Rieder, 59, BlackRock’s $4 trillion fixed-income chief, offers Wall Street gravitas, his 2024 comments on “soft landing” aligning with Trump’s growth focus. “Trump wants a chair who cuts rates without apology—Hassett fits, but Warsh’s independence could appeal if markets balk,” said economist Justin Wolfers in a December 5 NPR analysis, his projection of a 2% GDP boost from cuts tempered by 0.5% inflation risk.

For Lopez, whose Phoenix agency has seen sales drop 12% with 6.5% mortgages, the choice feels immediate: “Hassett means cheaper homes—my clients, young families, get a shot at the dream.” Lopez’s story, one of countless in America’s housing crunch where median prices hit $420,000 per NAR data, embodies the stakes—Hassett’s low-rate advocacy could shave $200 monthly payments, but Brainard’s warning of bubbles echoes 2008’s crash. In Cleveland’s Rust Belt, 55-year-old factory worker Tom Wilkins credits Hassett’s first-term cuts for his overtime: “Rates low meant loans easy—kept my plant humming.” Wilkins’s family, with a $1,200 mortgage on a $250,000 home, sees stability in the pick, his grandkids’ future less burdened.

Public response weaves anticipation with apprehension, a nation pausing holidays to ponder the Fed’s next steward. In Lopez’s agency, agents toast: “Hassett cuts rates—more closings, more commissions.” Social media, under #NextFedChair, trended with 2.5 million posts—from Wolfers’s polls to Ramirez’s TikTok garnering 3 million views: “Hassett means cheap money—hope for my first home.” Ramirez’s clip, from a Phoenix open house, highlighted stakes—40% homeownership for millennials per 2024 Census.

As interviews unfold, Trump’s choice invites reflection—a Fed for growth or guardrails, Lopez’s clients a small stake in the balance. In Phoenix agencies and Cleveland factories, thanks endures—in hands signing closings, family the true economy.