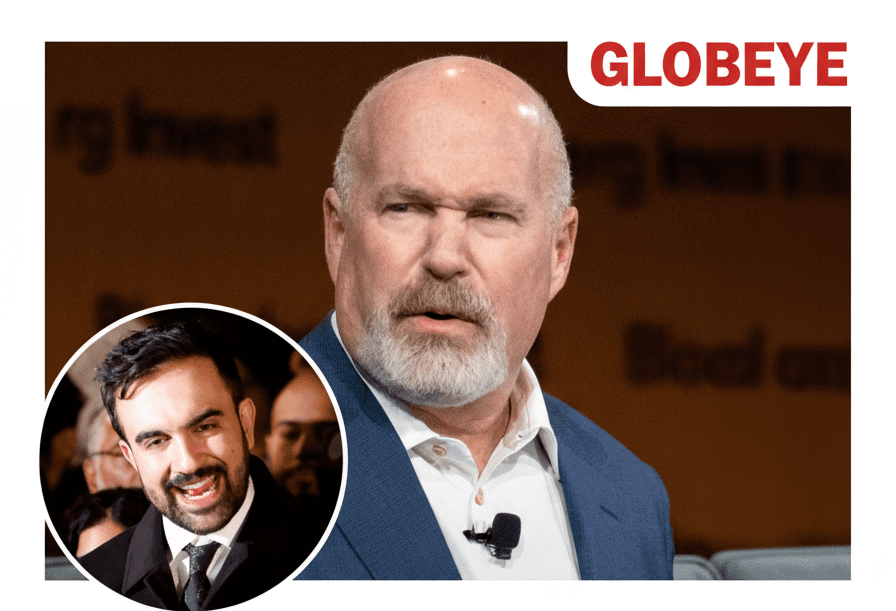

Hedge Fund Titan Cliff Asness Calls Zohran Mamdani’s Mayoral Rent-Freeze Pledge a “Hydrogen Bomb” for New York Real Estate

When a Wall Street titan describes a housing policy as a “hydrogen bomb,” it’s clear the stakes have gone far beyond ordinary campaign talk. Hedge fund billionaire Cliff Asness, a 59-year-old investor with a Forbes-estimated net worth of $2.9 billion, has issued a scathing rebuke of New York City mayoral frontrunner Zohran Mamdani’s proposal to freeze rents on stabilized apartments. In an exclusive interview, Asness warned that the policy would devastate the local real estate market, calling it a catastrophic idea disguised as compassion. His criticism was blunt and laced with sarcasm — “Come for the communism, stay for the globalizing of the intifada,” he said, referencing what he sees as the ideological undercurrent of Mamdani’s economic populism.

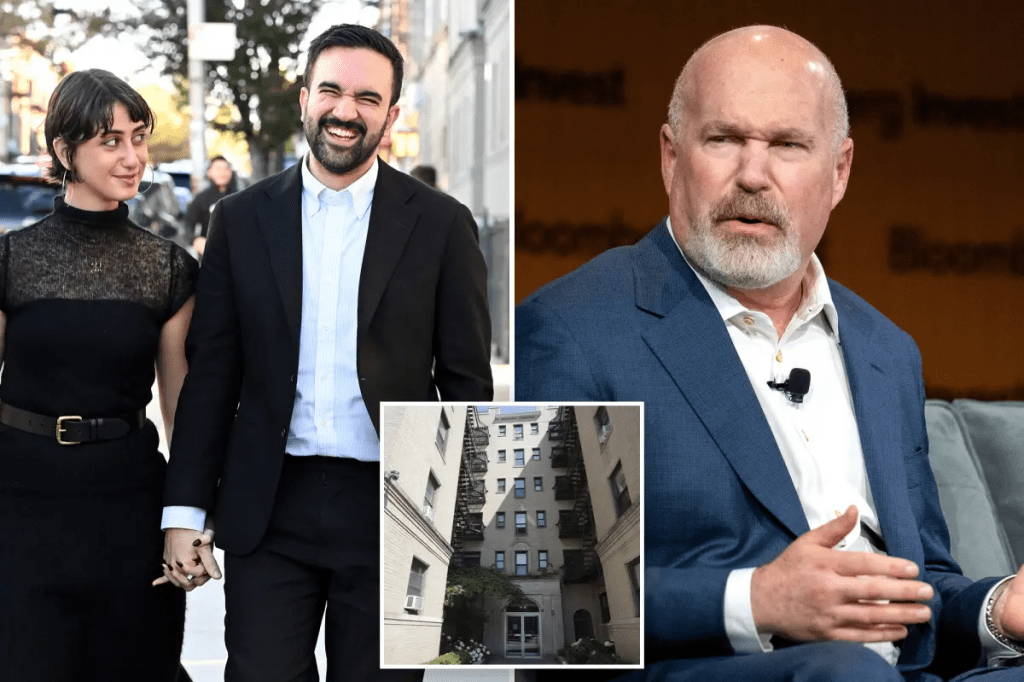

Mamdani, a 33-year-old progressive lawmaker who has built his campaign around tenant rights, has surged to the front of the mayoral race by promising to implement a four-year freeze on rent-stabilized apartments. The plan would affect nearly a million units across the city, halting all rent increases and effectively banning landlords from raising prices until 2029. For New Yorkers drowning under skyrocketing housing costs, the message is electrifying. For the city’s real estate industry and investors like Asness, it’s a ticking time bomb.

The billionaire, who co-founded the $160 billion asset-management firm AQR Capital, argued that Mamdani’s idea reveals a “dangerous misunderstanding” of how markets work. “It’s the economic equivalent of detonating a hydrogen bomb in the middle of a neighborhood,” he said. “You can’t destroy incentives, drain capital, and then act surprised when the city collapses under the weight of its own bad ideas.” He went on to accuse Mamdani of pushing “ideology over economics” and warned that landlords, property developers, and investors could flee the market, taking jobs and tax revenue with them.

At the center of the debate is a starkly divided New York. Renters, who make up two-thirds of the city’s population, have faced relentless price increases in recent years. Median rents in Manhattan crossed $4,500 in mid-2024, a historic record, while outer-borough rents rose by double digits. Mamdani’s campaign has capitalized on this anger, arguing that ordinary people are being “bled dry” while Wall Street and landlords grow richer. His rallies have drawn thousands, with supporters chanting slogans like “Homes, not profits.” To his base, the rent freeze is not radical — it’s overdue.

Yet the economic math tells a different story. Experts warn that a full rent freeze, even for a few years, could have severe ripple effects. Landlords facing frozen income streams would struggle to cover maintenance, insurance, and property-tax costs that continue to rise annually. Lenders, wary of repayment risk, might tighten financing for multi-unit housing, leading to fewer renovations and a slowdown in new construction. “You can’t regulate your way to affordability,” Asness said. “You have to build, invest, and grow — not punish the people who actually make housing possible.”

The friction between these two visions — activist populism and market realism — has become the defining battle of New York’s 2025 mayoral race. Mamdani’s team dismisses the criticism as fearmongering from billionaires defending their interests. “Of course Wall Street is terrified,” one campaign strategist said. “They’ve made a fortune off New York’s housing crisis. Cliff Asness can cry all he wants, but the city needs relief now.” That populist framing has worked before. The candidate’s social-media videos regularly rack up millions of views, painting him as a David taking on the city’s financial Goliaths.

Still, the optics of Asness’s intervention are significant. The hedge fund manager rarely enters political debates this directly. His comments to The New York Post mark one of the sharpest rebukes yet from the city’s business elite — and they signal mounting anxiety among investors that the next administration could upend decades of real-estate norms. Many developers are already warning of a “capital strike” if the policy moves forward. Property transactions across the city have dropped by more than 15 percent year-over-year, with some investors explicitly citing “policy uncertainty” as the reason for pausing deals.

Asness’s warning isn’t without historical precedent. Economists have long cited examples from cities like San Francisco, Stockholm, and Berlin, where strict rent controls led to chronic housing shortages, deteriorating building conditions, and black-market subletting. New York itself faced similar fallout after the post-war rent controls of the 1950s and ’60s, when thousands of landlords abandoned properties rather than operate at a loss. “We’ve been here before,” Asness said. “If you tell people they can’t make a fair return, they stop investing. The result isn’t fairness — it’s decay.”

Mamdani’s supporters counter that the comparison is outdated. They argue that today’s crisis demands unprecedented measures, and that the city’s top one percent can easily afford to absorb the costs. “Cliff Asness is worth billions,” one activist said outside City Hall. “He’s worried about landlords, not the families choosing between rent and groceries.” It’s a compelling emotional argument, one that resonates deeply in working-class neighborhoods — and one Mamdani’s campaign has leaned into heavily.

The larger question is how the proposal would function legally. Under state law, the city’s Rent Guidelines Board determines annual rent adjustments for stabilized apartments, based on landlord operating costs and inflation data. A mayor can influence the board’s decisions through appointments, but cannot unilaterally impose a rent freeze. Mamdani has vowed to “pressure and reform” the board if elected, suggesting he would stack it with tenant advocates and housing-justice activists. Critics say that strategy skirts due process and risks politicizing an institution that was designed to balance competing interests.

Meanwhile, Wall Street has begun quietly modeling the potential fallout. Analysts estimate that the freeze could wipe out between $30 billion and $50 billion in property value across the five boroughs if implemented as described. Tax revenues tied to property values could drop sharply, straining city budgets already under pressure from migrant-housing costs and infrastructure deficits. Some private-equity firms are reportedly exploring shifts to other markets, including Miami, Dallas, and Charlotte, where rent regulations are looser and investor confidence higher. “Capital is mobile,” Asness said pointedly. “It doesn’t have loyalty — it has memory. If New York forgets that, the city will pay for it.”

Even among Democrats, Mamdani’s plan has sparked quiet discomfort. Several moderate lawmakers have warned that an economic downturn caused by collapsing property values could backfire politically, harming the very tenants the policy aims to protect. Mayor Eric Adams, who has avoided taking a firm position in the race, said only that “any plan needs to balance compassion with common sense.” His cautious phrasing reflects what many in city government admit privately: that the political winds are shifting left, but the fiscal math hasn’t changed.

For now, Mamdani remains defiant. He insists that billionaires like Asness are part of the problem, not the solution. “When Wall Street complains,” he told supporters at a Queens rally, “you know you’re doing something right.” The crowd roared. But even his advisors concede privately that implementing a freeze of this scale will be a legal and financial minefield. “It’s a symbolic promise more than a policy,” one campaign aide admitted off record. “But symbols matter — especially in a city where people feel ignored.”

Cliff Asness, for his part, seems content to play the foil. He’s been through countless market cycles, from the dot-com boom to the 2008 crash, and his warning carries the weight of hard-earned experience. “Markets punish hubris,” he said. “You can ignore gravity for a while, but eventually it wins.” His remarks may be written off as alarmist by Mamdani’s followers, yet to New York’s business community, they sound like the voice of déjà vu.

In the coming weeks, as the mayoral campaign barrels toward its final debate, the clash between populism and pragmatism will likely define the city’s political tone for years. For many, the question isn’t just whether rent should be frozen — it’s whether New York can survive another round of ideological brinkmanship. The city that prides itself on never sleeping might soon find its real-estate market on ice.